Imagine a world where your crypto wallet tells your financial story. In decentralized finance (DeFi), that’s not just a dream, it’s becoming reality, thanks to the rise of onchain wallet scores. These scores are transforming how trust is built and how lending decisions are made across the crypto ecosystem. No more faceless addresses or guesswork about who’s on the other side of a transaction. Instead, your onchain activity becomes your digital reputation, opening doors to new opportunities and fairer access to capital.

Why DeFi Needs Onchain Credit Scoring

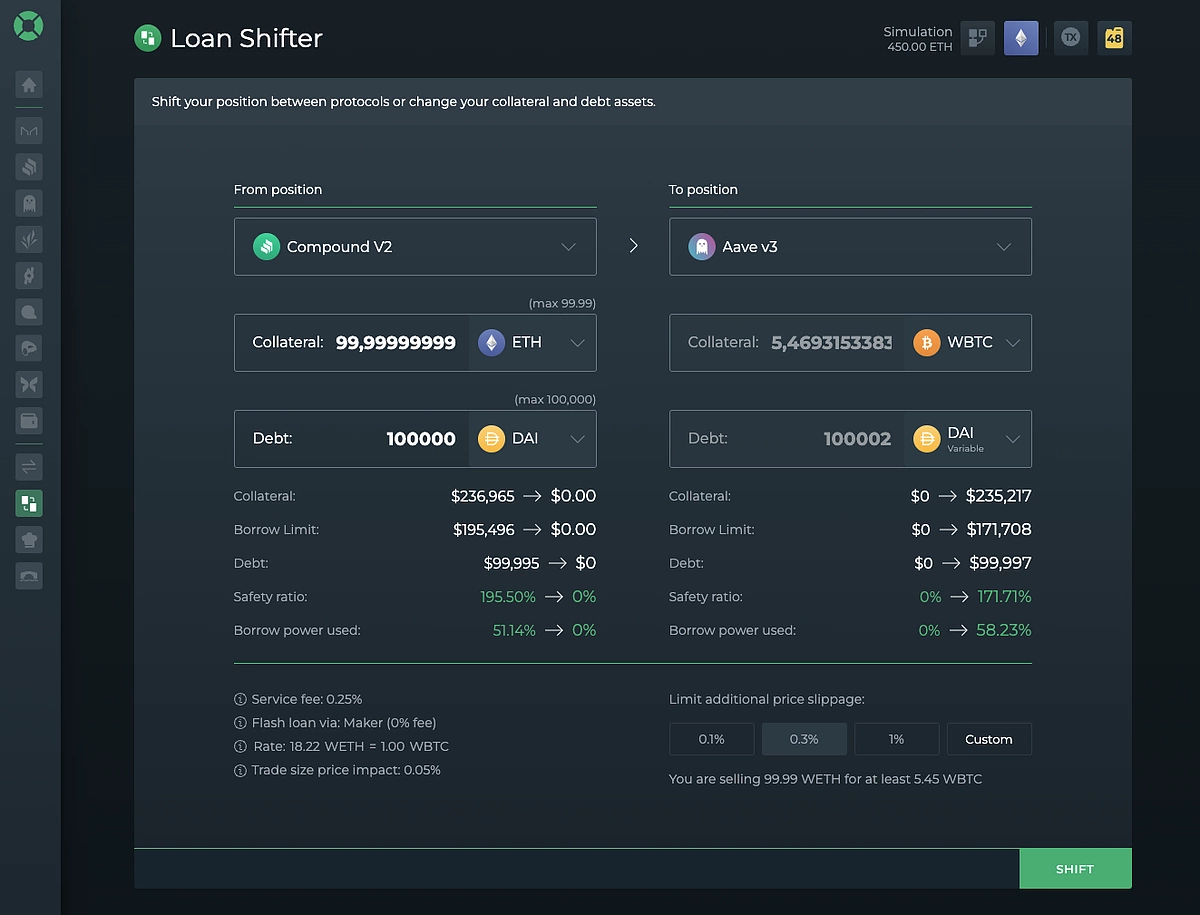

Let’s face it: traditional DeFi lending has always been a bit clunky when it comes to trust. Most protocols require borrowers to lock up more collateral than they want to borrow, simply because there’s no reliable way to judge creditworthiness in an anonymous environment. This overcollateralization keeps things safe but also locks out millions from accessing meaningful credit, and keeps trillions in potential liquidity sidelined (source).

Onchain wallet scores are changing this dynamic by analyzing your real DeFi actions: loan repayments, staking behavior, yield farming moves, and even participation in governance. Instead of relying on a static snapshot or off-chain paperwork, these scores continuously update as you build (or lose) trust on-chain.

The Mechanics: How Onchain Wallet Scores Are Built

So what goes into an onchain wallet score? It’s all about transparency and data-driven insights. Every transaction you make, whether it’s repaying a loan early, providing liquidity, or voting on protocol upgrades, feeds into an evolving profile that lenders can trust. Think of it as your decentralized financial résumé.

- Repayment history: Did you pay back that Aave loan on time? That’s a plus.

- Diversity of protocol usage: Engaged with multiple reputable platforms? Your score gets stronger.

- Wallet longevity: Old wallets with consistent positive activity often get higher marks.

- Risk events: Liquidations or missed repayments can ding your score, but recovery is possible with good behavior over time.

This system enables protocols to offer undercollateralized loans, sometimes requiring less than 100% collateral, based on real-time risk assessment (learn more here). The result? More capital efficiency for everyone involved!

The Ripple Effect: Trust and Dynamic Lending Terms

The impact isn’t limited to borrowers. For lenders and protocols, these scores unlock smarter risk management and dynamic pricing models. Platforms can now offer lower interest rates or reduced collateral requirements for wallets with high scores, directly rewarding responsible users while protecting against bad actors.

This approach is already being piloted by projects like ARCx with their “DeFi Passport, ” which tracks Ethereum address activities for real-time scoring. Meanwhile, big names like TransUnion are exploring ways to bridge traditional credit data with blockchain-native profiles, further expanding the reach of decentralized lending (see recent developments here).

As these onchain reputation systems mature, we’re witnessing the birth of a new kind of financial trust, one that’s open, verifiable, and programmable. Lenders are no longer flying blind. Instead, they can instantly assess wallet histories and adjust terms in real time. This means more competitive loan offers for responsible users and far fewer blanket restrictions that punish everyone for the mistakes of a few. For borrowers, your positive actions today can unlock better rates and lower collateral tomorrow, no paperwork or credit agency required.

What’s truly game-changing? Onchain wallet scores aren’t just about individual access; they’re also fueling the emergence of new DeFi primitives like peer-to-peer undercollateralized lending pools, risk-tranching vaults, and even decentralized insurance products that price coverage based on your onchain reputation. As more protocols tap into these transparent risk signals, we’ll see a virtuous cycle: increased trust brings more liquidity, which powers more innovation, and ultimately draws in users who were previously sidelined by opaque or exclusionary systems.

Challenges and What’s Next for Onchain Reputation

No revolution comes without its hurdles. While onchain risk scoring is a massive leap forward for decentralized lending trust, there are still open questions around privacy, data portability, and Sybil resistance (preventing one person from gaming the system with multiple wallets). The best projects are tackling these head-on with zero-knowledge proofs, decentralized identity frameworks (DIDs), and cross-chain analytics that help paint a fuller picture without doxxing users’ identities.

The next frontier? Seamless integration between off-chain and on-chain credit signals, imagine your traditional credit score complementing your DeFi rep so you can access loans across both worlds. With major institutions like TransUnion dipping their toes in crypto waters and platforms like ARCx pushing technical boundaries, the roadmap is clear: onchain wallet scores will be foundational to the future of finance.

How to Leverage Your Onchain Wallet Score Today

If you’re active in DeFi, or just getting started, now’s the time to take ownership of your onchain reputation:

- Repay loans promptly: Timely repayments boost your score across most protocols.

- Diversify your activity: Engage with reputable platforms beyond just one or two dApps.

- Avoid risky behaviors: Minimize liquidations and keep leverage under control.

- Track your score: Use tools from emerging platforms to monitor how lenders see you in real time.

The best part? Your efforts aren’t lost if you switch wallets or chains, many systems are working toward portable reputations that follow you wherever you go. Want to dig deeper into how these mechanics work? Check out this comprehensive guide: How On-Chain Credit Scores Work: Decentralized Reputation for DeFi Lending.

The bottom line: Your wallet is becoming your passport to opportunity in crypto finance. By embracing transparent scoring models now, both individuals and institutions can unlock fairer access to capital while making DeFi safer for everyone. Ready to level up? Start treating every transaction as a building block for your digital reputation, and watch new doors open as this ecosystem matures.