In the early days of DeFi, lending protocols were built on a single, unyielding pillar: over-collateralization. If you wanted to borrow, you had to lock up more value than you received. This model protected lenders but left vast swathes of the global population unable to access credit. The dream of an open financial system was hemmed in by the same risk-aversion that plagues traditional finance.

But the emergence of Decentralized Identity (DID) is quietly rewriting these rules. By enabling users to establish verifiable, privacy-preserving digital identities, DIDs empower DeFi platforms to assess borrower risk with unprecedented nuance. Instead of demanding mountains of collateral, protocols can now lean on cryptographically secure credentials and onchain risk scores – opening the door to truly under-collateralized lending in crypto.

From Anonymous Wallets to Verifiable Identities

The shift from anonymous addresses to robust digital identities marks a seismic change for decentralized finance. In traditional DeFi lending pools, everyone is just a string of hexadecimal characters. Lenders have no way of knowing whether a borrower has ever repaid a loan or defaulted spectacularly in the past. As noted by Block3 Finance, this lack of reputation forces protocols into defensive postures: high collateral requirements and limited risk appetite.

DID technology flips this dynamic by allowing users to assemble a portfolio of verifiable credentials linked to their activity – both on-chain and off-chain. Imagine presenting your repayment history from Spectra or Credora, proof of income from an onchain payroll protocol, or even privacy-preserving KYC attestations from idOS. All without ever exposing your underlying identity or leaking sensitive data.

This is not science fiction; it’s already happening across pioneering DeFi protocols and credit scoring platforms. The result? A new foundation for trust that isn’t based on brute-force collateralization but on real data and transparent behavior.

The Mechanics: How Onchain Risk Scores Power Under-Collateralized Lending

So how do these innovations play out in practice? At their core, under-collateralized lending platforms use smart contracts that integrate DID frameworks and credit scoring engines. When a user applies for a loan, they present cryptographically signed credentials – repayment records, asset proofs, or KYC attestations – which are verified against decentralized registries.

The protocol then computes an onchain risk score, reflecting factors like:

- Repayment history: Has the borrower previously defaulted or consistently paid back loans?

- Asset diversity: Does their wallet hold stablecoins, governance tokens, or volatile assets?

- KYC/AML status: Has the user passed privacy-preserving identity checks?

- Social graph: Are they part of reputable DAOs or networks?

This score allows lenders (or automated pools) to price risk dynamically – offering lower collateral requirements and better rates for trustworthy borrowers while protecting against malicious actors. For example, Clearpool and Credora have pioneered such systems where institutional borrowers can access capital with far less upfront collateral by leveraging their DID-based reputations.

The Privacy Paradox: Balancing Transparency and Anonymity

No discussion of decentralized identity would be complete without addressing its central tension: privacy versus transparency. Crypto’s ethos is rooted in self-sovereignty and pseudonymity; yet meaningful credit assessment demands some level of disclosure.

DID solutions like idOS are tackling this paradox head-on by enabling users to selectively disclose only what’s necessary for each transaction. Zero-knowledge proofs allow someone to prove they’ve never defaulted without revealing their full financial history. Smart contracts enforce these disclosures automatically – no centralized authority required.

This architecture not only preserves user autonomy but also aligns with emerging regulatory frameworks around privacy-preserving KYC in DeFi markets (read more here). The result is a system where trust is earned through transparent behavior rather than blind faith or invasive surveillance.

As these tools and standards mature, the DeFi ecosystem is witnessing the birth of a new credit marketplace, one that is both more inclusive and more robust. Borrowers who were previously locked out due to lack of collateral can now access liquidity based on their proven reliability. Lenders, meanwhile, gain access to a deeper pool of potential clients, with risk priced according to real data rather than arbitrary assumptions.

Protocols like Spectra and Credora are already demonstrating how onchain risk scores can drive capital efficiency. By integrating repayment analytics, wallet composition, and even DAO participation into their credit models, they enable dynamic lending terms tailored to each borrower’s risk profile. This isn’t just about cheaper loans, it’s about unlocking trillions in dormant capital that was previously sidelined by over-collateralization.

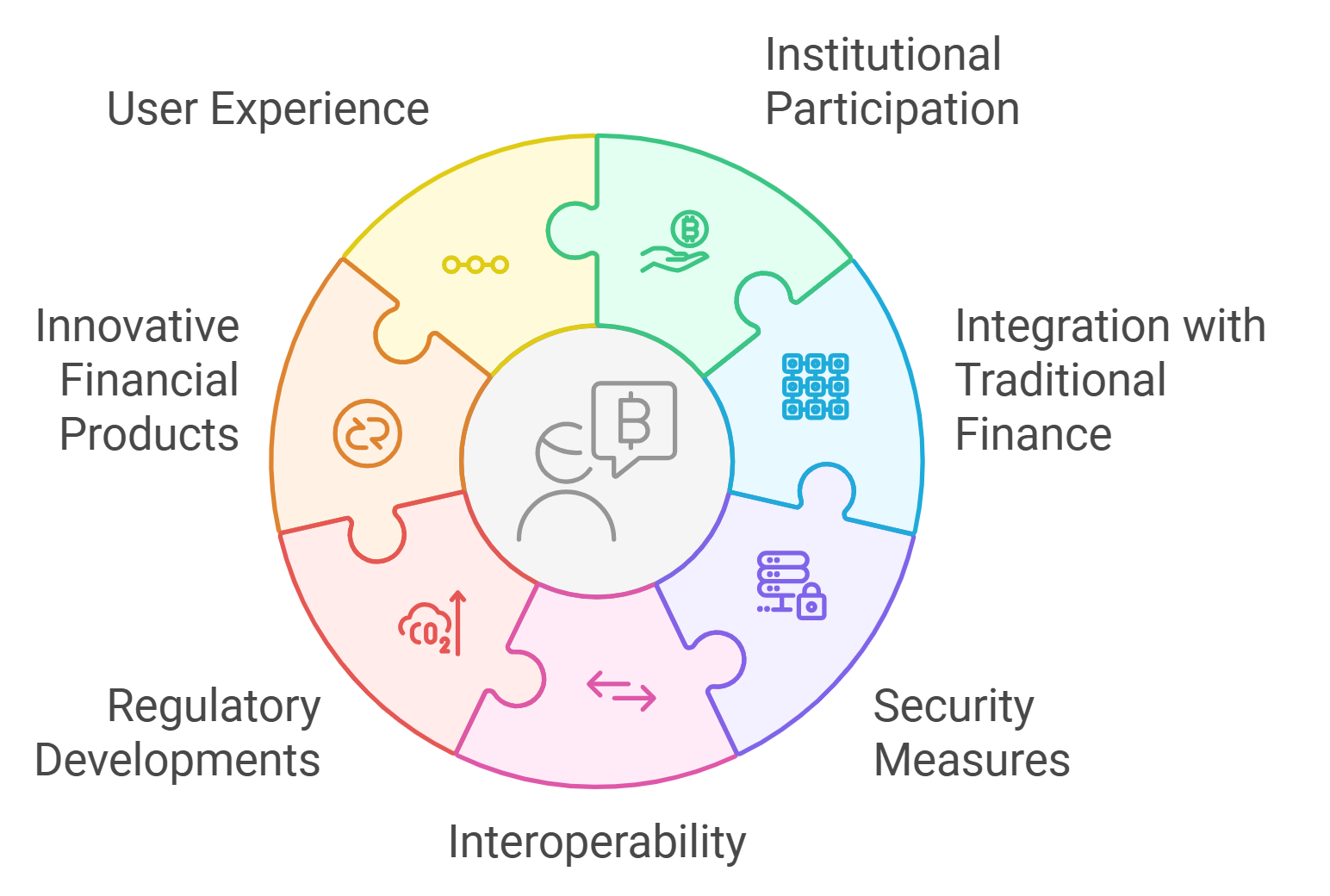

Challenges on the Road Ahead

Of course, this transformation is not without its hurdles. Interoperability remains a sticking point: multiple DID standards and credit protocols are vying for adoption, creating friction for users who want their identity (and reputation) recognized across platforms. The technical challenge of merging off-chain data, like income or employment records, with on-chain credentials also looms large.

Moreover, as noted by leading researchers and regulators alike, the question of privacy is never fully settled. Even with zero-knowledge proofs and selective disclosure mechanisms, there’s a constant push-pull between regulatory demands for transparency and user expectations of anonymity. The success of privacy-preserving KYC frameworks will hinge on striking a balance that satisfies both camps without undermining the core values of DeFi.

The Future: Decentralized Credit as Public Infrastructure

The implications extend far beyond crypto-native circles. As DID-powered under-collateralized lending matures, it could become a template for global credit markets, especially in regions where traditional financial infrastructure is weak or exclusionary. Imagine a world where your onchain reputation travels with you across borders and platforms, granting you access to loans, insurance, or even jobs based solely on transparent proof of your behavior.

This vision is not merely aspirational; it’s taking shape today in the codebases and governance forums of pioneering DeFi projects. The next wave will likely see even tighter integration between decentralized identity frameworks and advanced risk analytics, potentially including AI-driven credit scoring engines that learn from millions of anonymized transactions in real time.

For developers building tomorrow’s protocols or users seeking fairer access to capital markets, understanding this landscape is essential. DID technology doesn’t just reduce friction; it redefines what trust means in an open economy, and invites everyone to participate on equal footing.

If you’re interested in exploring these innovations further or want to see how DID-powered lending compares across platforms, check out our comprehensive guide here.

The bottom line? The era of over-collateralization as the default setting for DeFi lending is ending. In its place rises a system where reputation, verified through decentralized identity, is the new collateral. As more protocols adopt these standards and as users build portable reputations across chains and applications, under-collateralized lending will shift from experiment to mainstream reality.