In 2025, the landscape of under-collateralized crypto lending is undergoing a seismic shift. The driver: on-chain risk scores. These blockchain-native credit assessments are replacing blunt over-collateralization with nuanced, data-driven lending decisions. For years, DeFi lending protocols required borrowers to lock up more collateral than they borrowed, limiting capital efficiency and excluding many would-be participants. Now, on-chain risk scoring is unlocking new credit opportunities while maintaining rigorous risk controls.

From Over-Collateralization to Data-Driven Credit

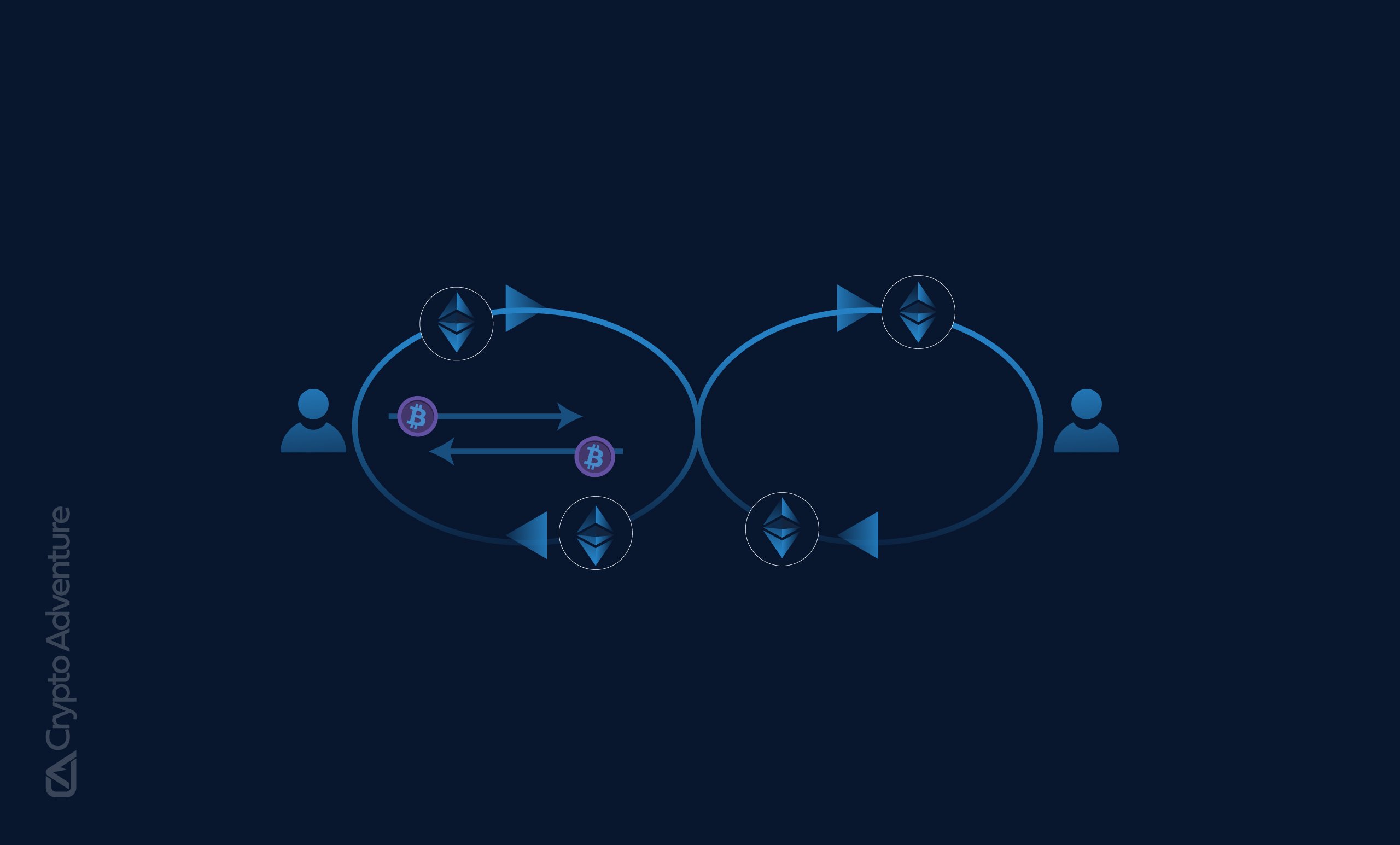

The traditional DeFi model has relied heavily on over-collateralization as a safeguard against default. This approach, while effective for protocol safety, leaves vast amounts of capital idle and restricts access for users lacking substantial assets. In contrast, on-chain risk scores leverage a borrower’s transaction history, repayment patterns, and protocol interactions to build an objective risk profile. This enables dynamic adjustment of loan terms – such as collateral requirements and interest rates – based on real-time data rather than static rules.

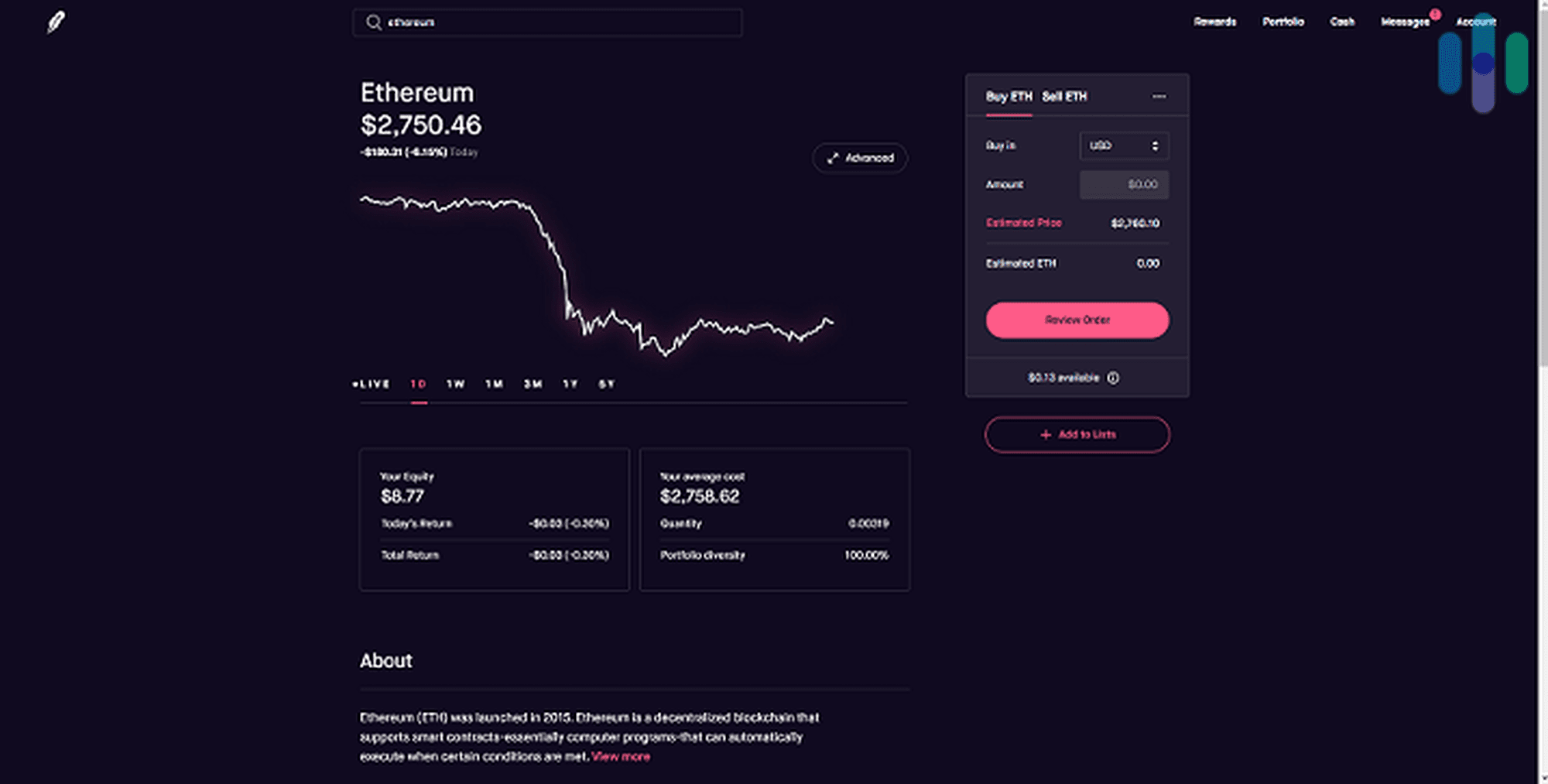

Platforms like RociFi exemplify this evolution by categorizing borrowers into pools according to their blockchain-derived creditworthiness. Those with strong on-chain reputations access under-collateralized loans with favorable terms, while higher-risk users face stricter requirements or higher rates. This system not only increases capital efficiency but also incentivizes responsible behavior across the ecosystem.

The Scale of On-Chain Lending in 2025

The numbers underscore the magnitude of this transformation. As of August 2025, $51.7 billion in stablecoins were borrowed in a single month, contributing to a cumulative stablecoin lending volume exceeding $670 billion since January 2020 (source: Visa). Decentralized finance (DeFi) platforms now account for 45.31% of all crypto collateralized lending market share at the end of Q1 2025 (source: CoinLaw), outpacing centralized finance (CeFi) alternatives.

This explosive growth is directly linked to the adoption of on-chain risk scoring models. By quantifying borrower risk using transparent blockchain data rather than opaque off-chain metrics, DeFi protocols can safely extend credit to a broader user base without demanding excessive collateral.

Integrating Traditional Credit Data On-Chain

The synergy between established financial data and decentralized systems is further enhancing risk assessment accuracy. In March 2025, Untangled Finance and Moody’s Ratings successfully brought Moody’s credit ratings onto the blockchain (source: CoinDesk). This breakthrough allows DeFi lenders to incorporate both on-chain behavioral analytics and traditional credit information into their underwriting frameworks.

The result is a more holistic view of borrower risk – one that combines global financial history with transparent digital asset activity. As decentralized credit bureaus aggregate these datasets using open-source frameworks, borrowers’ reputations become portable across protocols and chains, driving composability and fairness across the ecosystem.

Decentralized Credit Assessment: The New Standard

The rise of decentralized credit bureaus marks another critical milestone in this evolution. These entities standardize reputation data from multiple sources and protocols, ensuring that a user’s positive repayment history or responsible borrowing behavior can travel seamlessly between platforms. Open-source scoring frameworks promote transparency and allow for continuous improvement as new data streams emerge.

This composable approach not only enhances trust among counterparties but also reduces friction for both borrowers and lenders seeking optimal terms across the rapidly expanding DeFi landscape.

Borrowers are no longer siloed by protocol or limited by the lack of a unified credit identity. Instead, their on-chain actions create a persistent reputation that can be leveraged for better loan terms and access to capital. Lenders, in turn, gain confidence from standardized risk models and transparent repayment histories, enabling more competitive rates and innovative lending structures.

Decentralized Credit Assessment Workflow in 2025

-

1. On-Chain Data Collection: Borrowers’ blockchain activities—such as transaction history, loan repayments, and protocol interactions—are aggregated in real time by platforms like RociFi and Gauntlet.

-

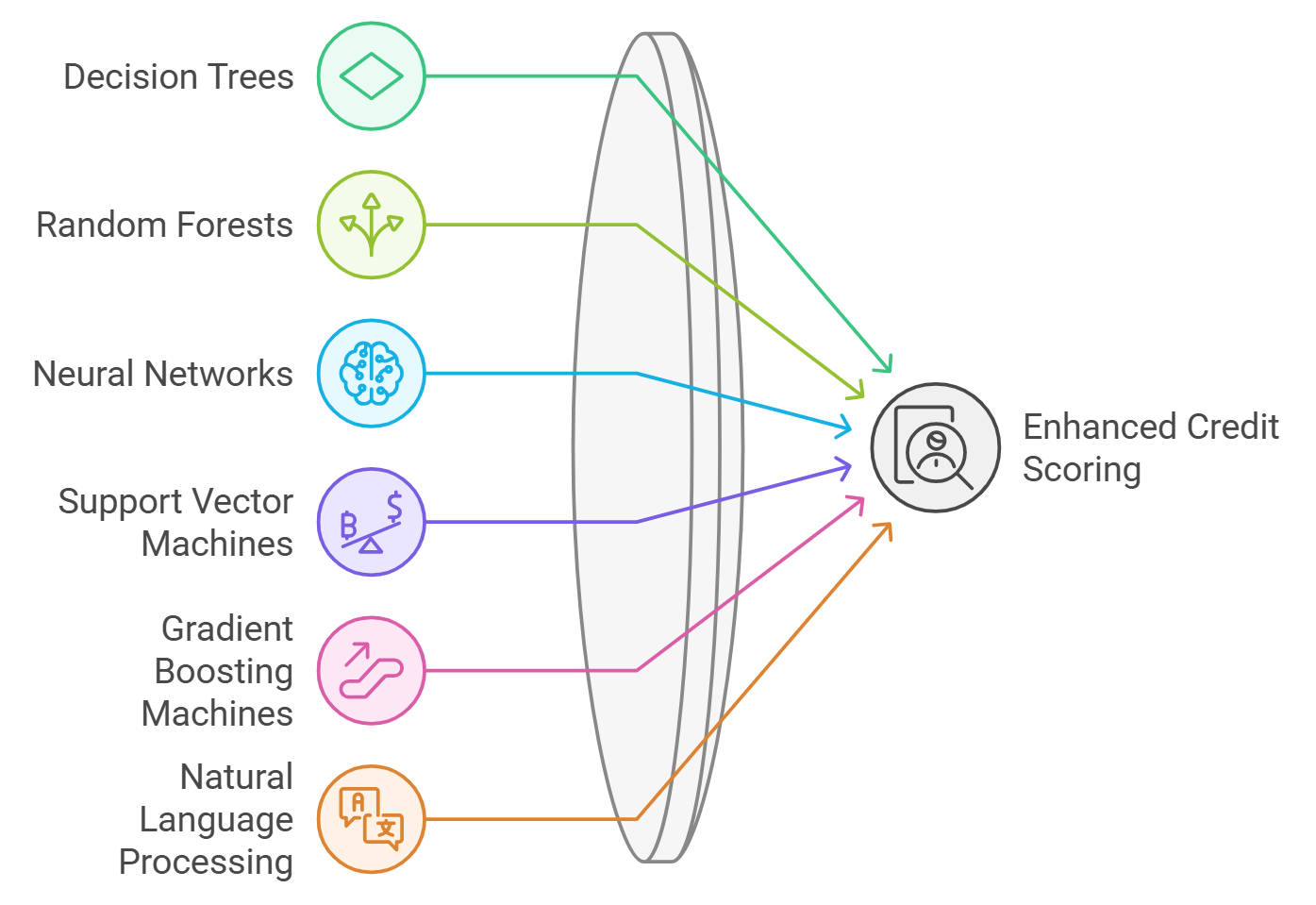

2. Risk Scoring Algorithms: Advanced scoring models, including RociFi’s credit scoring system and Chaos Labs’ risk engines, analyze collected data to generate a quantitative risk profile for each borrower.

-

3. Integration of Traditional Credit Data: Platforms such as Untangled Finance integrate Moody’s Ratings on-chain, enhancing risk assessments with established financial data and increasing score accuracy.

-

4. Decentralized Credit Bureaus: Open-source platforms like CryptoCreditScores.org standardize and aggregate on-chain reputation data, enabling portable credit profiles across DeFi protocols.

-

5. Dynamic Loan Terms & Borrower Mobility: Lending protocols (e.g., Aave, Compound) use risk scores to offer under-collateralized loans with tailored rates and collateral requirements, allowing borrowers’ reputations to follow them across DeFi.

As these decentralized credit bureaus mature, composability becomes a powerful force multiplier. Imagine a borrower who repays loans punctually on one platform; their reputation score instantly qualifies them for under-collateralized offers elsewhere, without redundant onboarding or opaque manual reviews. This fluidity is already reshaping user expectations in DeFi lending for 2025.

Risk Scoring: Driving Capital Efficiency and Inclusion

The adoption of on-chain risk scores is increasing both capital efficiency and financial inclusion. Protocols can now allocate capital more intelligently, reserving higher collateral requirements only for users with weaker risk profiles. This means that responsible borrowers can unlock greater leverage or lower rates, while lenders minimize default risks through real-time analytics.

The data-driven nature of decentralized credit assessment also opens the door to previously excluded market segments. Users without traditional bank accounts or formal credit histories can build blockchain-native reputations and access loans based solely on their on-chain behavior. This is particularly impactful in emerging markets where legacy infrastructure is lacking but crypto adoption is surging.

Challenges Ahead, and the Path Forward

While the benefits are substantial, several challenges remain. Privacy concerns around sharing sensitive transaction data must be addressed with robust encryption and zero-knowledge proofs. The risk of Sybil attacks, where users attempt to game reputation systems, necessitates ongoing refinement of scoring algorithms and identity verification standards.

Regulatory clarity will also play a pivotal role as more institutional capital flows into DeFi lending markets. Recent guidance from regulators like the NYDFS indicates that blockchain analytics expectations are expanding to cover all banking activities involving digital assets. Protocols must balance innovation with compliance to ensure sustainable growth.

Despite these hurdles, the momentum behind on-chain risk scoring is undeniable. As composable reputation frameworks mature and integration with traditional credit data deepens, under-collateralized crypto lending will continue to gain traction as a mainstream alternative to legacy finance.

Key Takeaways for 2025

- On-chain risk scores are making under-collateralized lending safer and more accessible by leveraging transparent blockchain data.

- The integration of traditional credit ratings enhances underwriting accuracy for DeFi protocols.

- Decentralized credit bureaus standardize reputation data, enabling borrower mobility across platforms and chains.

- This evolution is boosting capital efficiency while promoting global financial inclusion in crypto markets.

Lenders, borrowers, and builders should stay attuned to developments in decentralized risk assessment as it redefines how trust, and capital, flow through web3 finance. For further reading on how these innovations are shaping tomorrow’s DeFi landscape, see our deep dive: How On-Chain Credit Scores Are Transforming DeFi Lending Risk Assessment.