In 2025, the world of decentralized finance (DeFi) is buzzing with a new wave of innovation: on-chain risk scores. These digital credit profiles are transforming the way crypto loans are issued, especially when it comes to under-collateralized lending. For years, DeFi lending was synonymous with over-collateralization. If you wanted to borrow $1,000 in stablecoins, you typically had to lock up $1,500 or more in crypto assets. This model kept lenders safe but left huge amounts of capital idle and locked out millions of potential borrowers.

Fast forward to August 2025: an eye-popping $17.5 billion in stablecoins is sitting in lending protocols, with $14.8 billion (that’s a whopping 84%) actively utilized in loans (source). The surge isn’t just about bigger numbers – it’s about smarter credit allocation and fairer access to capital thanks to on-chain credit scoring.

What Are On-Chain Risk Scores?

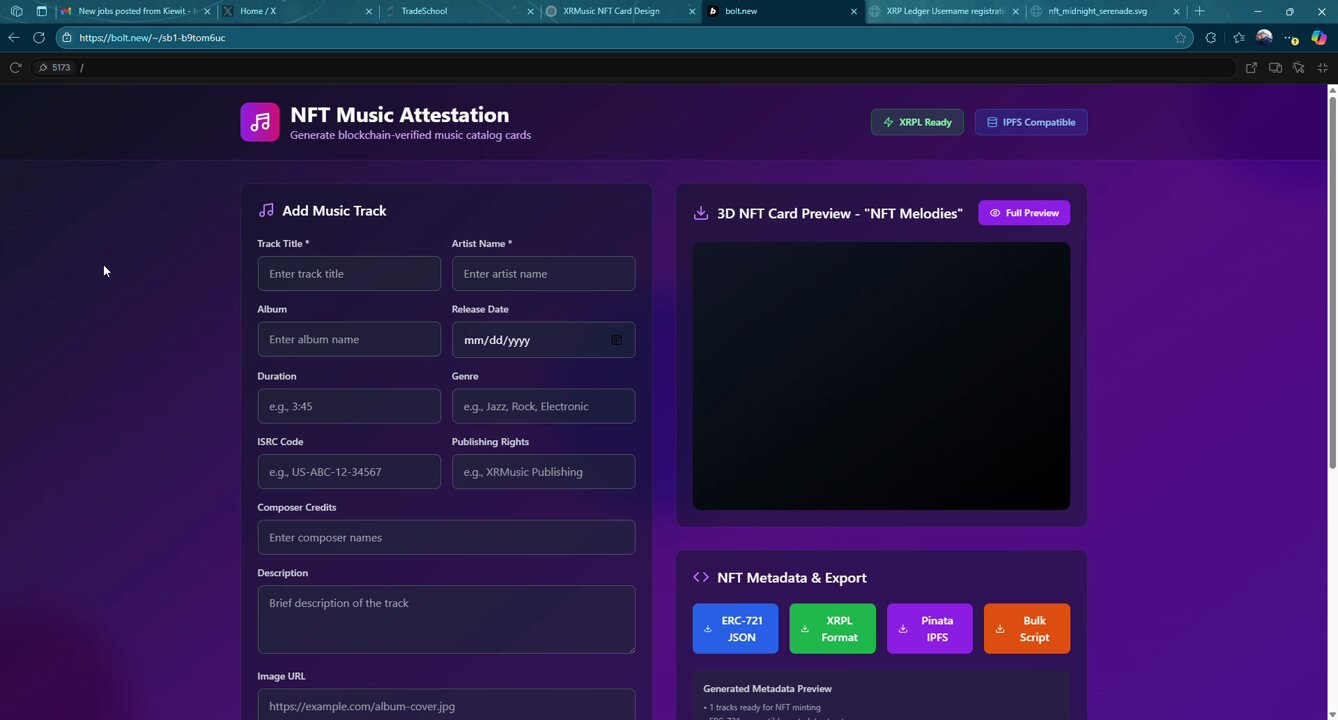

On-chain risk scores are like your blockchain-based credit report. Instead of relying on opaque, centralized agencies, these scores analyze your wallet’s public transaction history: past loans and repayments, liquidation events, asset diversity, protocol interactions, and even patterns that suggest responsible (or reckless) behavior. All this data is aggregated into a transparent score that lenders can trust – and you can prove.

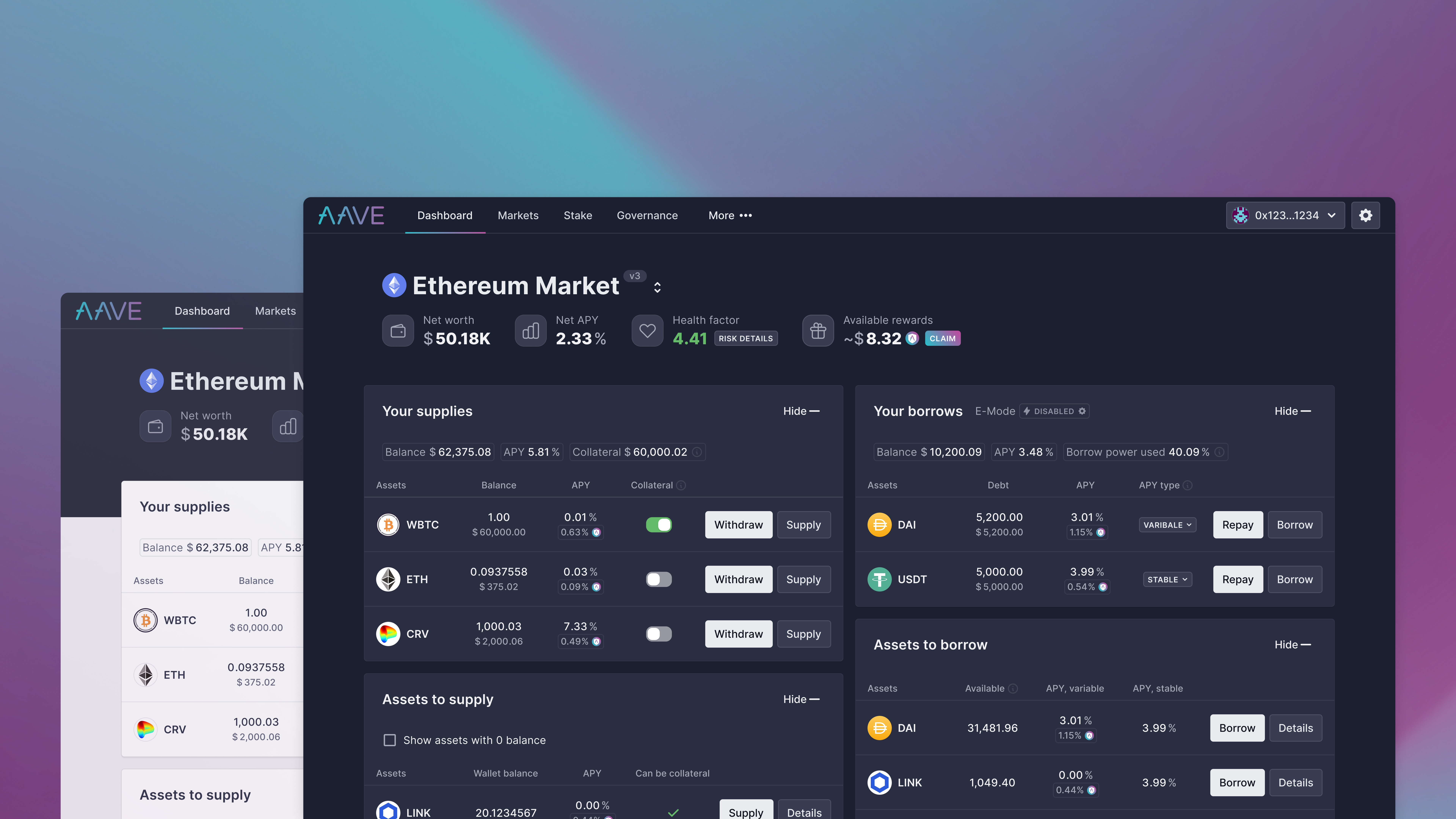

This isn’t just theory. Protocols like RociFi, Aave, and Compound are already using these systems to shake up the old rules:

- RociFi: Assigns each borrower a dynamic risk score based on fraud checks and repayment behavior; users with stronger profiles can borrow with as little as 71% collateralization.

- Aave: Adjusts loan-to-value ratios and interest rates dynamically by analyzing real-time wallet activity across DeFi protocols.

- Compound: Personalizes loan terms for borrowers with solid on-chain reputations – lower collateral requirements for proven track records.

This is where the magic happens: by leveraging decentralized identity (DID) frameworks and immutable repayment histories, DeFi finally starts looking less like a walled garden for whales and more like an open marketplace for all.

The Mechanics Behind Under-Collateralized Crypto Loans

The traditional over-collateralized model made sense when there was no way to verify who you were dealing with. But now? On-chain analytics let lenders see exactly how wallets behave across time and protocols – no more flying blind! Here’s how it works:

- Your wallet activity is continuously analyzed: Every repayment or default updates your score in real time.

- Lending platforms set flexible terms: If your score shows reliability, you’re rewarded with higher loan-to-value ratios or lower interest rates. Riskier borrowers face stricter terms or higher rates.

- DIDs add another layer: Decentralized identity solutions allow users to link multiple wallets or even off-chain credentials without compromising privacy.

This means that responsible borrowers can unlock capital without locking up their entire portfolio as collateral – a game-changer for power users and newcomers alike.

The Benefits: Efficiency Meets Inclusion

The ripple effects of this shift are massive:

- Bigger impact per dollar: Less collateral required means more assets circulating productively across DeFi.

- No more one-size-fits-all lending: Borrowers are evaluated on their actual behavior instead of arbitrary rules.

- Easier onboarding for new users: Solid repayment history? You’re in! Even if you don’t have mountains of ETH sitting idle.

- Lenders get transparency and control: With standardized risk scores visible on-chain, they can fine-tune their exposure instead of guessing who’s behind each wallet address.

This isn’t just theoretical progress – it’s already driving record growth. On-chain cryptocurrency collateralized loans jumped by 42% in Q2 2025 alone, reaching an all-time high of $26.5 billion (see more here). As these systems mature, expect even greater capital efficiency and broader global participation in crypto credit markets!

Challenges remain, of course. Gaming the system is still possible if users spread risk across multiple wallets or attempt to manipulate on-chain behaviors. Privacy concerns are front and center too: while transparency is a DeFi superpower, it can also expose sensitive patterns if not handled thoughtfully. That’s why leading protocols are experimenting with privacy-preserving credit scores, zero-knowledge proofs, and Ethereum Attestation Service integrations to strike the right balance between openness and user protection.

Another crucial point is score standardization. Not all risk scoring models are created equal. Some platforms weigh protocol diversity more heavily, while others focus on repayment frequency or even social signals from DAOs and governance forums. The industry is moving toward interoperable standards so your reputation travels with you, no matter which dApp or lending protocol you use next.

How to Build Your On-Chain Credit Reputation

If you’re ready to tap into under-collateralized crypto loans in 2025, here’s how to get started:

Actionable Steps to Build a Strong On-Chain Credit Score

-

Repay Loans On Time Across Multiple Platforms: Timely repayment of loans on platforms such as RociFi, Aave, and Compound demonstrates creditworthiness and positively impacts your on-chain risk score.

-

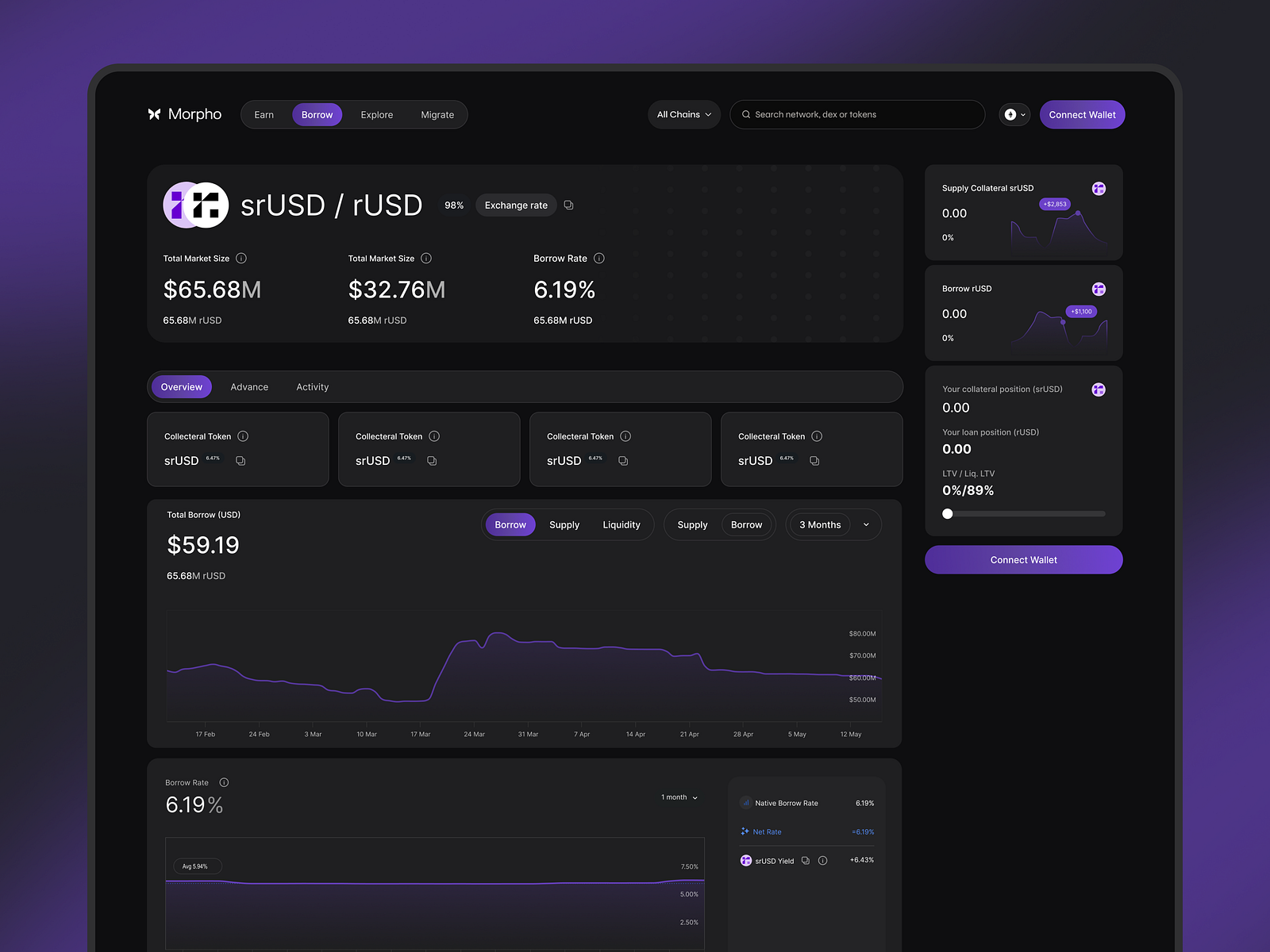

Diversify Your DeFi Interactions: Use a variety of decentralized applications (dApps) and lending protocols, including Morpho, to show a broad, healthy on-chain footprint. This reduces perceived risk by credit scoring systems.

-

Maintain Healthy Collateral Ratios: Keep your loan-to-value (LTV) ratios well within safe limits, even when borrowing on under-collateralized platforms. This signals prudent risk management to on-chain credit assessors.

-

Engage with Decentralized Identity and Reputation Services: Link your wallet to services like Ethereum Attestation Service (EAS) or Galxe to enhance your verifiable on-chain reputation, which is increasingly factored into credit scores.

-

Protect Your Wallet’s Security and Avoid Liquidations: Use hardware wallets and enable multi-signature security to prevent hacks or unauthorized transactions, and monitor positions to avoid liquidation events, which can negatively impact your risk score.

-

Monitor and Optimize Your On-Chain Credit Score: Regularly check your risk score on platforms like RociFi or Creditcoin Network, and take corrective actions if your score drops.

Consistency is key: Make repayments on time, avoid liquidations, and engage with reputable platforms that report your activity to decentralized credit bureaus. Over time, your wallet will develop a trustworthy track record that unlocks better borrowing terms.

Diversify your activity: Interact with multiple DeFi protocols, not just one lending pool. Many scoring systems reward users who demonstrate responsible behavior across various apps and chains.

Leverage DID tools: Consider linking your wallets using decentralized identity solutions. This can help consolidate your positive reputation and reduce friction when seeking loans across different platforms.

Looking Ahead: What’s Next for On-Chain Risk Scores?

The momentum behind under-collateralized crypto loans isn’t slowing down. As stablecoin usage in lending protocols continues to surge, remember that $17.5 billion figure from August 2025?: expect even more sophisticated risk models and cross-chain integrations to emerge (learn more here). Projects like Creditcoin are already piloting unsecured lending for wallets with stellar reputations, hinting at a future where DeFi rivals (or even surpasses) TradFi in both access and adaptability.

The bottom line: on-chain risk scores are unlocking a new era of efficiency, inclusion, and transparency in crypto lending. Whether you’re a power user optimizing capital or a newcomer seeking your first loan without mountains of collateral, the doors have never been wider open, and the data has never worked harder for you.