In the evolving landscape of decentralized finance, onchain risk scores are quietly reshaping how we approach lending. Gone are the days when borrowers needed to lock up 150% or more in collateral just to access a loan. Instead, protocols are turning to verifiable onchain repayment history to gauge trustworthiness, unlocking a path to undercollateralized DeFi loans that feel more like traditional credit but with blockchain’s transparency. This shift isn’t hype; it’s a pragmatic response to capital inefficiency, where overcollateralization ties up billions in idle assets while excluding users without deep crypto holdings.

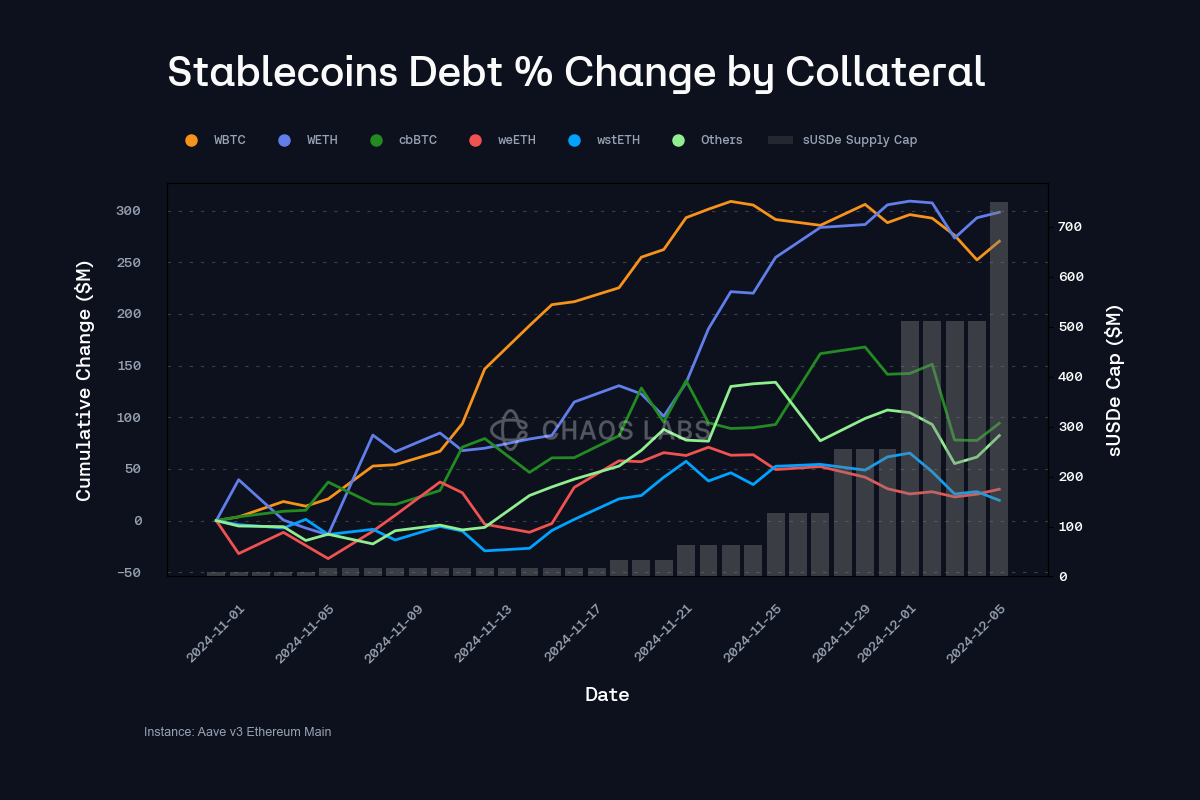

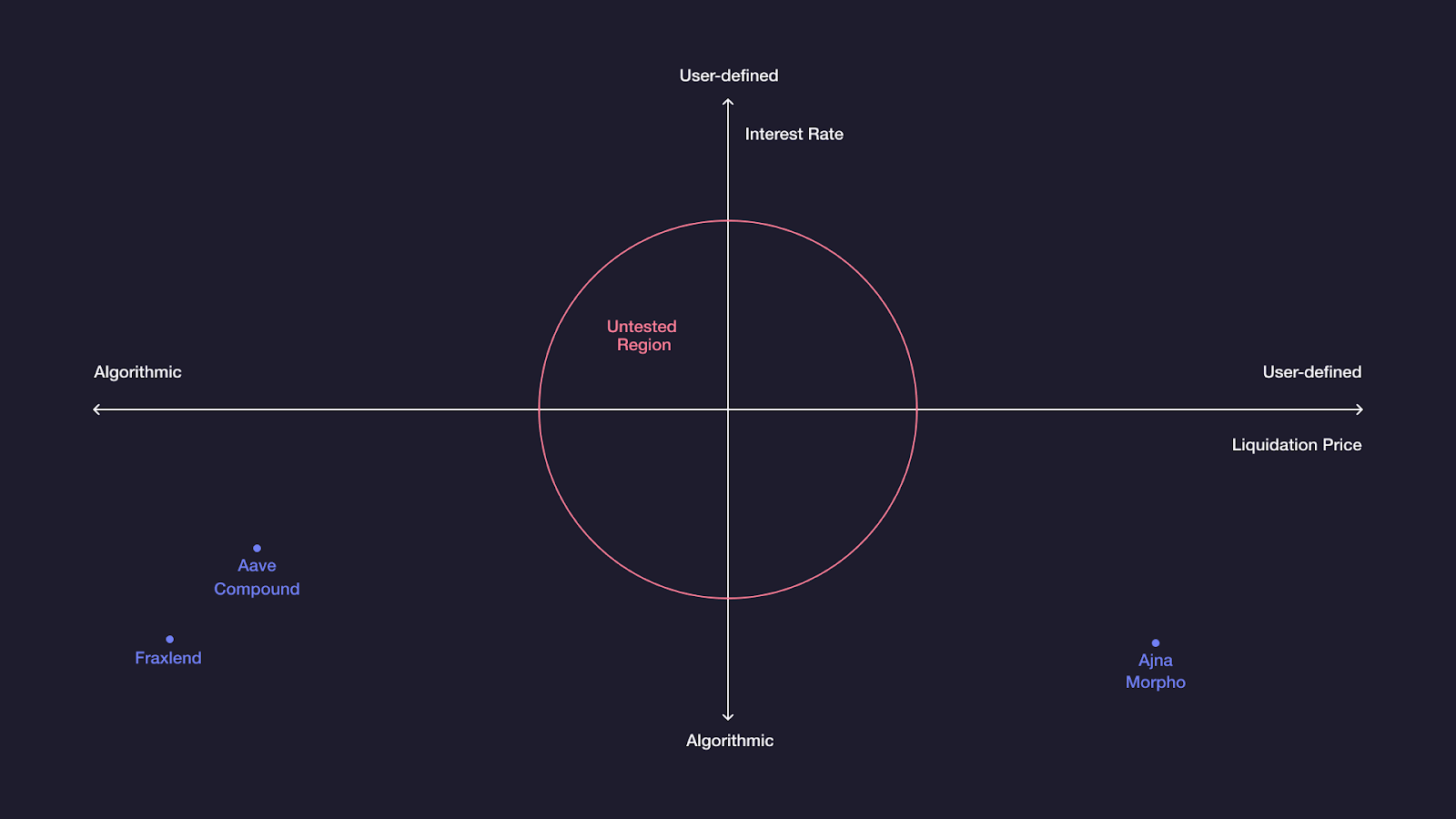

Consider the current DeFi lending scene in 2026. Aave and Compound still dominate with 89% of volume as of August 2025, per Visa’s insights, but their overcollateralized models limit scalability. Reports from Galaxy Research highlight how risk assessment hinges solely on collateral-to-borrow ratios, ignoring a borrower’s proven track record. Enter crypto credit scoring: by analyzing repayment patterns, loan-to-value ratios, and interaction histories onchain, lenders can extend credit with minimal or no collateral. Platforms like Goldfinch and TrueFi exemplify this, blending blockchain data with selective offchain signals for nuanced evaluations.

Why Overcollateralization Falls Short in 2026

Overcollateralization made sense in DeFi’s early wild west, mitigating smart contract risks and counterparty defaults without identity layers. But today, it creates friction. Borrowers must pony up excess assets, often stablecoins or ETH, which sit idle until repayment or liquidation. This locks liquidity; imagine tying up $1.5 million to borrow $1 million. For institutions eyeing onchain lending, as noted in This Week in Fintech, it’s a non-starter when traditional debt markets offer flexibility.

Moreover, liquidation cascades during volatility amplify losses. A minor dip triggers mass sales, eroding protocol stability. ZARTOM’s analysis nails it: onchain credit scoring spells the death of this model by unlocking dormant liquidity. Borrowers build reputations through consistent repayments, much like FICO scores in TradFi, but immutable and public. The Onchain Foundation projects trillions flowing into DeFi once undercollateralized lending matures, fueled by these scores.

Decoding Onchain Repayment History as a Risk Signal

At its core, onchain repayment history is a ledger of truth. Every loan taken, interest paid, and deadline met (or missed) lives forever on Ethereum or Layer 2s. Protocols aggregate this into scores by weighting factors like repayment velocity, debt-to-income analogs from wallet flows, and cross-protocol behavior. AI steps in to detect patterns humans miss, such as seasonal borrowing tied to yield farming cycles.

TrueFi, for one, mandates backers vote on loans after reviewing borrower dossiers enriched by onchain data. Goldfinch goes further, using junior/senior tranches to align incentives. CoinGecko underscores how this builds long-term trustworthiness, easing future DeFi lending without collateral. Risks persist, sure; defaults happen. But backers earn premiums for bearing them, creating a market-driven equilibrium absent in blind overcollateralization.

Top Advantages of Onchain Risk Scores

-

Capital Efficiency: Eliminates overcollateralization requirements in protocols like Aave and Compound, freeing up billions in idle assets for productive use (89% DeFi volume in 2025).

-

Broader Access: Enables undercollateralized loans via platforms like Goldfinch and TrueFi, opening credit to users without substantial crypto holdings.

-

Reputation Building: Borrowers develop verifiable on-chain credit histories, boosting future borrowing power as seen in emerging protocols.

-

Reduced Liquidations: Precise risk assessments minimize forced sales, stabilizing markets amid volatility in DeFi lending.

-

AI-Enhanced Accuracy: Integrates AI with on-chain data for superior risk scoring, accelerating adoption in 2026 undercollateralized lending.

Pioneering Protocols and Their Playbooks

Goldfinch leads with its unique borrower pooling, where unique identifiers link repayment histories across loans. Lenders fund pools backed by light collateral plus scores derived from prior performance. TrueFi focuses on institutional-grade undercollateralized credit, verifying real-world revenue streams alongside onchain proofs. Mitosis University details how these blend onchain and offchain data for holistic crypto credit scoring.

Hybrid models emerge too, per Earnpark’s Bitcoin lending review. CeFi platforms incorporate onchain histories to offer competitive rates, bridging TradFi and DeFi. Mary Tran’s LinkedIn post on private onchain credit pegs this as a trillion-dollar shift, with smart contracts automating underwriting. For developers, open-source score oracles make integration seamless, plugging into Aave-like interfaces without forking core logic. Check out this deeper dive on implementation tactics.

Crypto Adventure’s 2026 outlook tempers enthusiasm: success hinges on robust risk controls and stablecoin depth. Yet, with AI refining models, undercollateralized loans could dominate, especially as enterprises pour billions into onchain rails.

That realism grounds the conversation. Undercollateralized lending isn’t a silver bullet, but paired with sophisticated onchain risk scores, it addresses DeFi’s growing pains head-on. The key lies in layering defenses: diversified backer pools, insurance wrappers, and dynamic pricing tied to score tiers. Platforms are already stress-testing this in real capital deployments, proving resilience even amid 2026’s choppy markets.

Navigating Risks in Undercollateralized DeFi Loans

Defaults loom as the elephant in the room. Without full collateral backing, one bad actor could ripple through pools. Yet, history shows onchain data catches most red flags early; serial defaulters get blacklisted across protocols via shared oracles. Galaxy Research points out how traditional onchain lending ignores behavioral signals, but new models don’t. AI parses wallet heuristics, like token churn or mixer usage, flagging high-risk profiles before funds deploy.

Regulatory shadows add complexity. As enterprises shift billions onchain, per This Week in Fintech, KYC mandates could clash with pseudonymity. Protocols counter with optional DID integrations, preserving privacy while satisfying compliance. Smart contract audits remain non-negotiable; a single exploit could tank trust. Still, the upside outweighs: lenders capture higher yields from risk-adjusted premiums, borrowers scale without asset dumps.

Key Metrics Comparison: Overcollateralized (Aave/Compound) vs. Undercollateralized (Goldfinch/TrueFi)

| Metric | Overcollateralized (Aave/Compound) | Undercollateralized (Goldfinch/TrueFi) |

|---|---|---|

| TVL | $42B | $3.2B |

| Avg LTV | 68% | 115% |

| Default Rates | <0.1% | 2.3% |

| APY Ranges (Suppliers) | 2-10% | 7-22% |

| Collateral Requirement | 150-250% | 0-60% |

Opinion: I’ve watched hybrid strategies outperform pure CeFi or DeFi plays across cycles. Onchain repayment history turns speculation into signal, much like equity correlations I track daily. Borrowers who repay promptly see scores climb, unlocking better terms; it’s meritocracy coded in.

Practical Steps to Leverage Onchain Risk Scores

Developers and users alike can plug in today. Open APIs from score providers let apps query histories in real-time, feeding into custom lending logic. Start small: borrow modestly on TrueFi, repay early, watch your score compound. Institutions build bespoke models, blending onchain purity with offchain anchors like invoices. For everyday DeFi users, this means DeFi lending without collateral becomes viable, not just for whales.

Looking ahead, zero-knowledge proofs will supercharge privacy-preserving scores, letting users prove repayment streaks without doxxing wallets. Visa’s stablecoin report hints at this convergence, with onchain lending volumes poised to eclipse spot DEXes. Crypto Adventure’s caveat holds: pair scores with quality stables and deep liquidity to thrive.

Goldfinch’s pool model shines here, tranching risk so conservative lenders skim senior yields while adventurers chase juniors. TrueFi’s revenue attestations add grit, verifying cash flows onchain. Together, they chart a path where undercollateralized DeFi loans scale to trillions, as Onchain Foundation forecasts.

FAQs on Onchain Risk Scores

Undercollateralized lending matures not through perfection, but iteration. Protocols refine algorithms quarterly, backtested on years of chain data. Lenders diversify, borrowers build deliberately. In 2026, this isn’t fringe; it’s the efficient frontier where capital flows freely, risks quantified transparently. Platforms like cryptocreditscore. org stand ready with tools to score, lend, and thrive in this new era.