Decentralized finance (DeFi) has revolutionized access to financial services, but the reality for many small DeFi communities is that traditional overcollateralized loans remain out of reach. The requirement to lock up assets exceeding the loan amount creates a high barrier to entry, especially for users with limited crypto holdings. Undercollateralized lending promises a more inclusive path forward, and at the heart of this evolution are onchain risk scores.

Why Overcollateralization Holds Back Small DeFi Communities

The dominance of overcollateralized lending in DeFi is rooted in risk aversion. Protocols like Aave and Compound require borrowers to deposit collateral worth more than their loan, often 120% or higher, to protect lenders from defaults. While effective for protocol solvency, this model excludes participants who lack significant crypto assets but may have strong repayment histories and reliable onchain activity.

This limitation is acute in emerging or niche DeFi communities where capital is scarce. For these groups, access to small dollar DeFi loans can be life-changing, fueling project growth, liquidity provision, or even day-to-day operations. The challenge: how can lenders assess borrower trustworthiness without traditional credit checks or physical collateral?

Key Differences: Overcollateralized vs. Undercollateralized DeFi Lending

-

Collateral Requirements: Overcollateralized lending (e.g., Aave, Compound) requires borrowers to deposit more crypto than the loan amount, often 120% or more, to protect lenders from defaults. Undercollateralized lending (e.g., TrueFi, Maple Finance) allows loans with little or no collateral, relying on credit assessments instead.

-

Capital Efficiency: Overcollateralized lending is capital-inefficient, as users must lock up more value than they borrow. Undercollateralized lending increases capital efficiency by allowing borrowers to access funds with less or no collateral, unlocking liquidity for small DeFi communities.

-

Access and Inclusivity: Overcollateralized loans restrict access to users with substantial crypto holdings. Undercollateralized loans expand access to users with strong onchain reputations but limited assets, supporting broader financial inclusion.

-

Risk to Lenders: Overcollateralized lending minimizes lender risk through excess collateral and automatic liquidations. Undercollateralized lending exposes lenders to higher default risk, mitigated by advanced risk models, onchain monitoring, and legal agreements (as seen with Maple Finance and TrueFi).

-

Technology and Data Use: Overcollateralized platforms primarily use price oracles and liquidation bots. Undercollateralized platforms leverage AI, onchain analytics, and decentralized identity (e.g., Spectral) to build dynamic credit profiles.

The Mechanics of Onchain Risk Scores

Onchain risk scores are a data-driven solution designed specifically for blockchain-native environments. Instead of relying on opaque credit bureaus or legacy financial records, these scores analyze transparent blockchain data points:

- Wallet transaction history: Frequency and volume of transfers across protocols.

- Repayment patterns: Timeliness and consistency in settling previous loans.

- Diversification: Interactions with multiple DeFi platforms and assets.

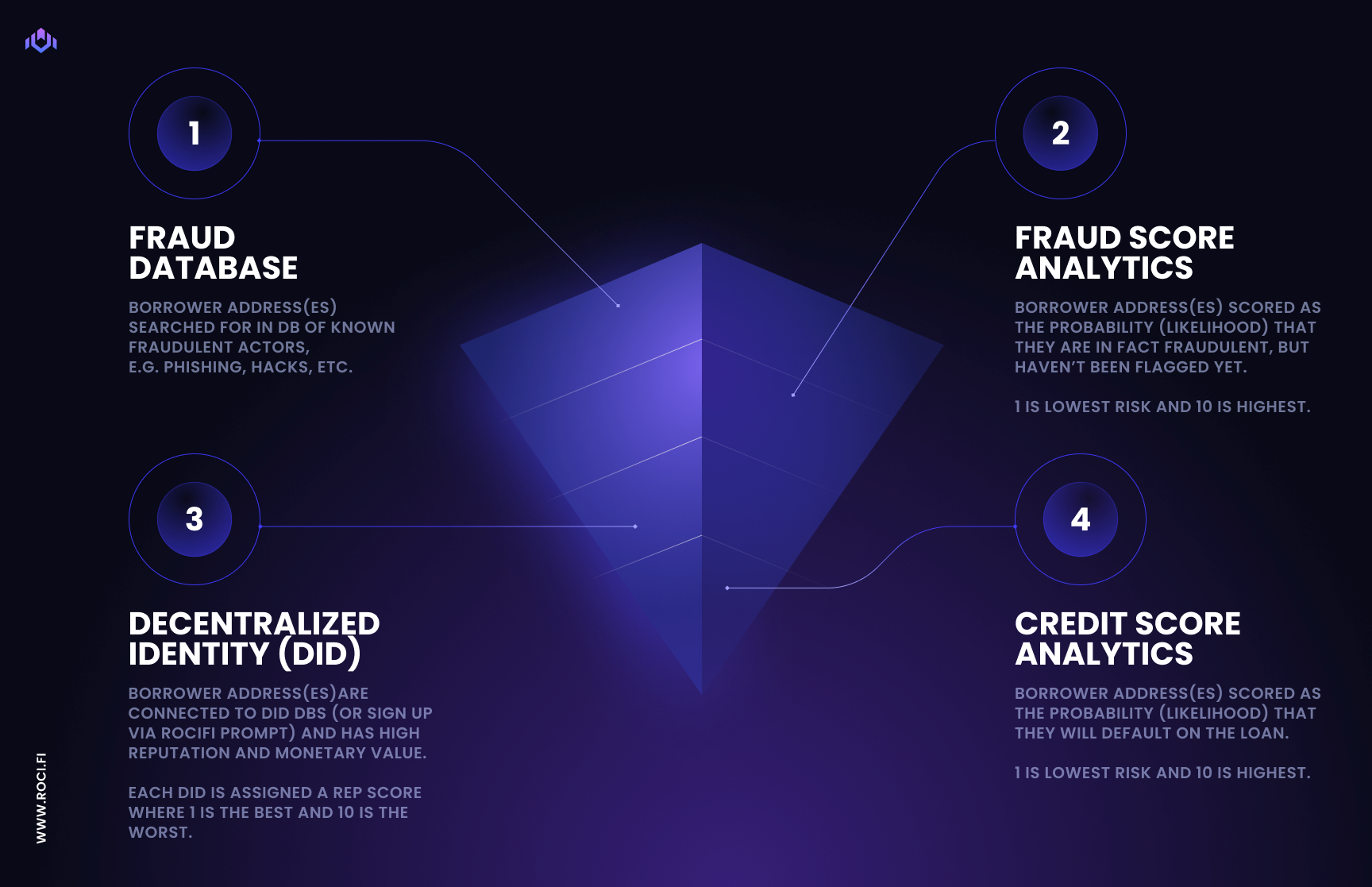

- Decentralized identity (DID): Verifiable credentials tied to wallet addresses.

This approach allows protocols to generate a holistic picture of an individual’s or entity’s financial behavior, entirely onchain and tamper-proof. Platforms such as RociFi and Spectral have pioneered decentralized identity credit scoring using AI-powered analytics, while academic research (see “On-Chain Credit Risk Score in Decentralized Finance”) continues to refine probabilistic modeling for borrower risk assessment.

The Undercollateralized Lending Opportunity: Beyond Capital Efficiency

The transition toward undercollateralized lending is not just about capital efficiency, it’s about unlocking new forms of trustless lending tailored for small communities. By leveraging onchain risk scores, lenders can confidently extend credit based on actual blockchain activity rather than arbitrary asset requirements.

This innovation is already reshaping the market landscape:

- Lenders gain access to broader borrower pools, increasing platform liquidity and potential yields.

- Borrowers with strong onchain reputations but modest holdings can secure funding, driving grassroots ecosystem growth.

- Lending decisions become more transparent and auditable, reducing information asymmetry between counterparties.

The result? Small DeFi communities are empowered to participate fully in decentralized finance, without the burden of excessive collateralization. For detailed guidance on integrating these systems into your workflow, see our resource at /how-on-chain-risk-scores-enable-under-collateralized-crypto-loans.

As the infrastructure for onchain risk scores matures, small DeFi communities are uniquely positioned to benefit from this paradigm shift. These communities often operate with high levels of transparency and social cohesion, making them ideal testbeds for decentralized identity credit and trustless lending models. By surfacing verifiable onchain behaviors, such as consistent loan repayments or active participation in protocol governance, risk scoring systems can reward responsible actors with greater borrowing access and more favorable terms.

Mitigating Risks Through Smart Contract Design and Dynamic Scoring

Robust risk management remains paramount. While undercollateralized lending introduces new opportunities, it also elevates default risk. Leading protocols are responding by embedding dynamic risk assessment directly into smart contracts. For example, borrower risk scores can be recalculated in real time as new transactions occur, allowing lending terms or access to capital to adapt dynamically. Automated liquidation triggers and insurance pools further protect lenders from outsized losses.

Moreover, the use of decentralized oracles ensures that external data, such as asset prices or protocol health metrics, is incorporated into credit decisions without introducing single points of failure. Regular smart contract audits and bug bounties have become industry best practices to safeguard protocol integrity.

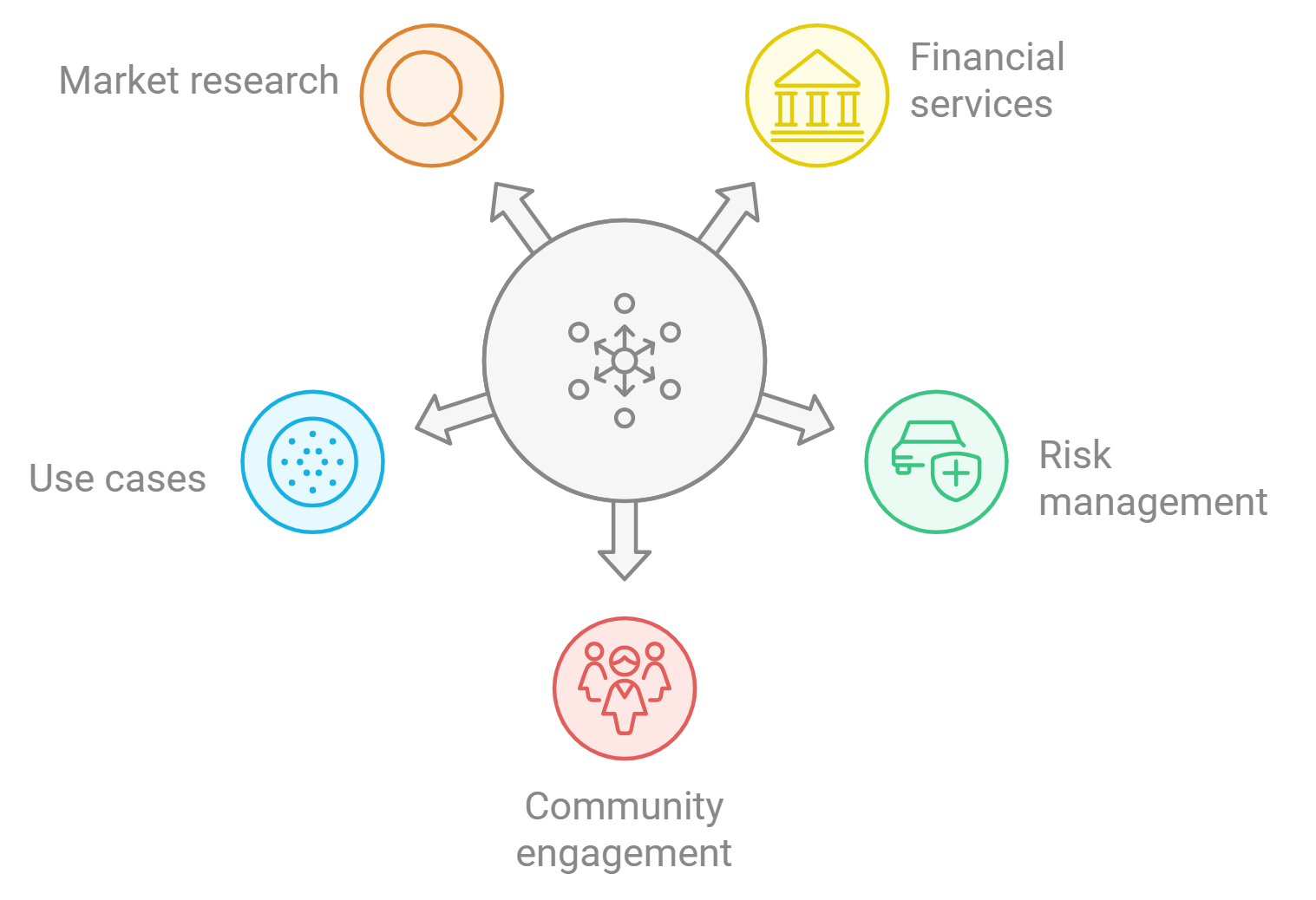

Unlocking Small Dollar DeFi Loans: Use Cases and Early Results

The practical impact of undercollateralized lending is already evident across several verticals:

- Small business microloans: Entrepreneurs in emerging markets can access working capital without traditional gatekeepers.

- DAO funding rounds: Community members with provable reputations receive advances for project contributions or liquidity provision.

- User onboarding: First-time DeFi users build credit history through manageable loans, fostering long-term ecosystem engagement.

Early data suggests that default rates among borrowers with high onchain risk scores are significantly lower than those with sparse or negative histories, validating the predictive power of these models (see “On-Chain Credit Risk Score in Decentralized Finance”). As adoption grows, expect further refinement in how protocols weigh factors like wallet age, transaction diversity, and cross-protocol activity.

What’s Next? Building Trust at Scale

The evolution toward undercollateralized crypto lending is still unfolding. Regulatory clarity will be a decisive factor, protocols must balance innovation with compliance as global frameworks mature. In parallel, improvements in decentralized identity standards (DID) will make it easier for users to port their reputations across platforms while maintaining privacy.

Lenders seeking sustainable yields should look beyond raw collateral ratios and embrace holistic crypto credit scoring methods that leverage transparent data streams. Borrowers can proactively manage their onchain footprint to unlock better rates and larger loans over time. For more insights on integrating these innovations into your workflow, visit /how-onchain-risk-scores-enable-under-collateralized-crypto-lending.

The convergence of onchain analytics, smart contract automation, and decentralized identity is setting a new standard for trustless finance, one where small DeFi communities are no longer sidelined by legacy constraints but empowered to shape the next chapter of global credit markets.