In the rapidly evolving landscape of decentralized finance (DeFi), one of the most persistent barriers to broader adoption is the requirement for borrowers to over-collateralize their loans. This practice, while safeguarding lenders, creates capital inefficiencies and excludes many users who lack substantial crypto assets. The emergence of on-chain risk scores offers a transformative path forward, enabling under-collateralized lending by leveraging transparent blockchain data to assess creditworthiness in real time.

What Are On-Chain Risk Scores?

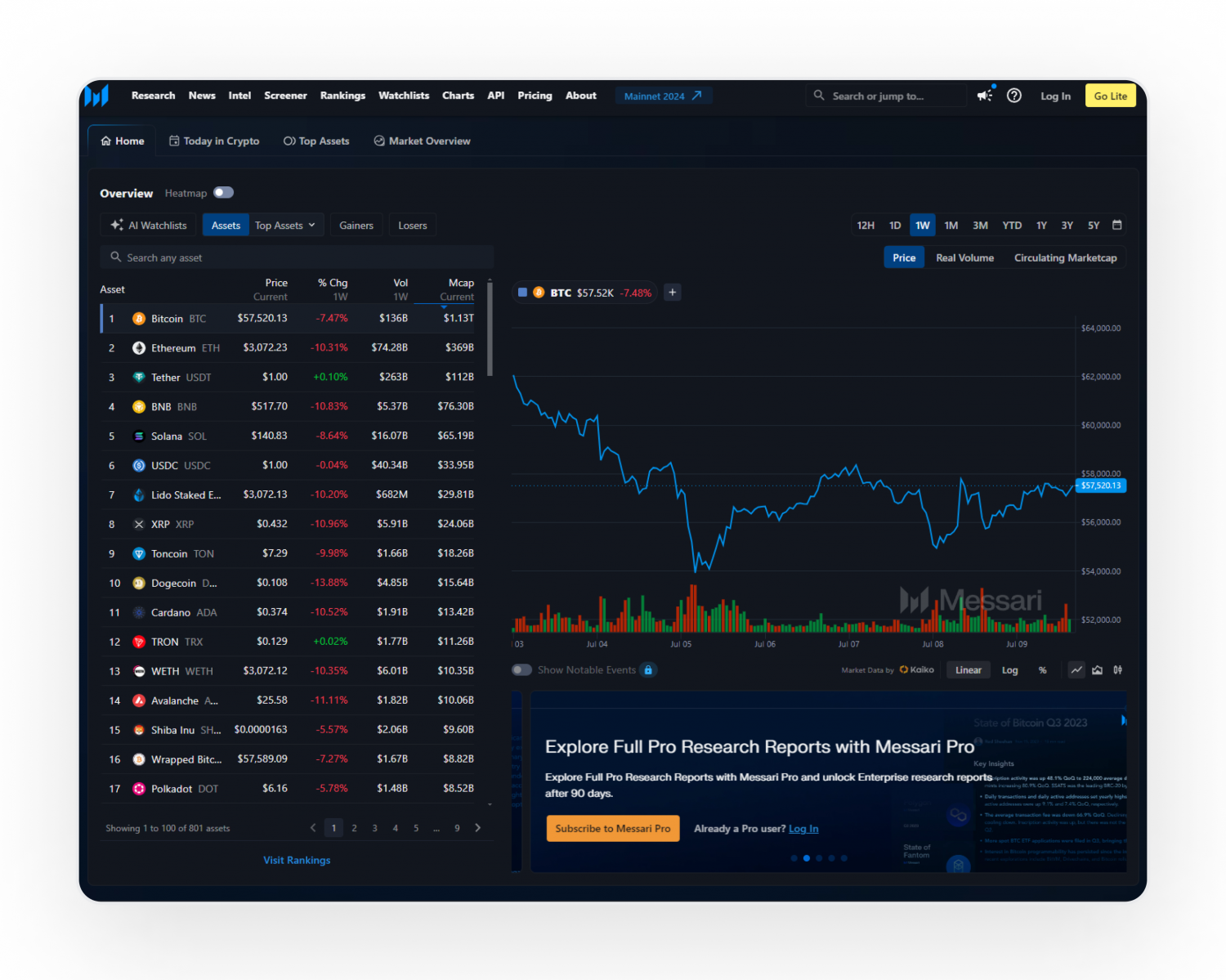

Unlike traditional credit scoring systems that rely on opaque, off-chain financial records and third-party reporting agencies, on-chain risk scores are derived from a user’s blockchain activity. Every wallet interaction, transaction history, loan repayment event, and even participation in governance or staking protocols can be analyzed to build a comprehensive picture of a borrower’s behavior. This data is immutable and publicly accessible, allowing DeFi platforms to create dynamic risk models that reflect both historical performance and current liabilities.

A typical on-chain risk score incorporates:

- Historical repayment behavior: Timely repayments signal reliability.

- Outstanding debts: High leverage or unpaid loans increase default probability.

- Network interactions: Engagement with reputable protocols can boost trustworthiness.

- Diversification of assets: A diversified portfolio reduces liquidation risks.

This approach enables nuanced lending decisions without relying on invasive personal data collection. For those interested in deeper technical details about how these scores are constructed and used in lending protocols, see resources like the Chainlink blog and recent arXiv research on OCCR Scores.

The Mechanics Behind Under-Collateralized Lending

The true innovation lies in how these risk scores empower protocols to extend loans with less than full collateralization. Platforms such as RociFi have pioneered multi-dimensional scoring systems that assign each borrower a unique risk profile. Borrowers with higher scores, reflecting strong onchain repayment history and prudent financial management, can access loans with significantly lower collateral requirements compared to traditional models.

This flexibility enhances capital efficiency across the ecosystem. Lenders can better price risk by adjusting interest rates or collateral ratios based on the borrower’s score. Meanwhile, borrowers gain access to liquidity without tying up excessive assets. The result is an expanded pool of participants who can engage in DeFi markets more freely, an essential step for mass adoption.

Key Advantages of On-Chain Risk Scores in DeFi Lending

-

Improved Capital Efficiency: On-chain risk scores allow DeFi platforms like RociFi to offer loans with reduced collateral requirements, enabling borrowers to access more credit with less locked-up capital.

-

Enhanced Financial Inclusion: By assessing blockchain activity instead of traditional credit histories, under-collateralized lending powered by on-chain risk scores opens access to credit for users without substantial crypto holdings or conventional financial backgrounds.

-

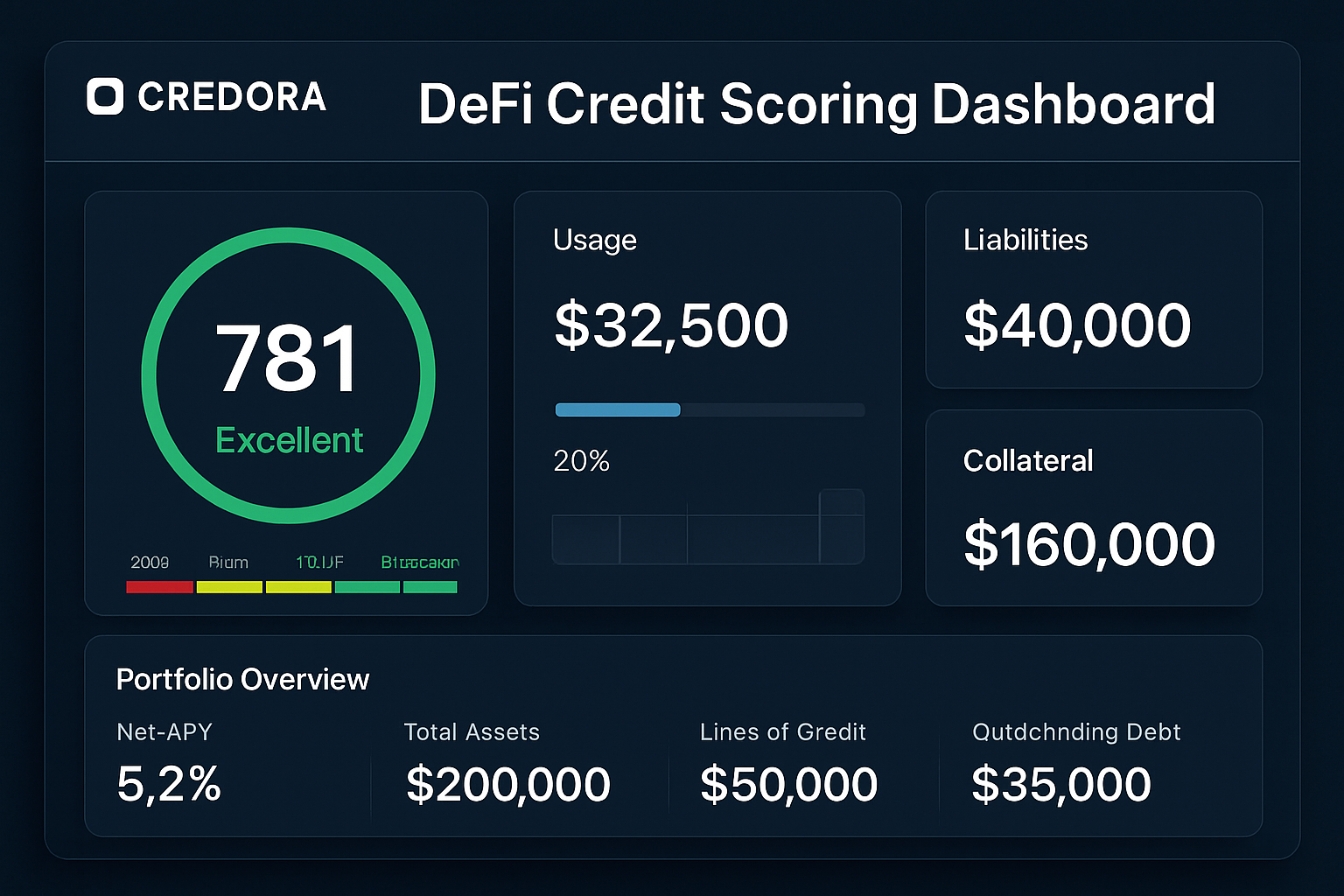

Dynamic, Transparent Risk Assessment: Platforms such as Credora utilize on-chain data to continuously update borrower risk profiles, ensuring loan terms are tailored to current creditworthiness and increasing transparency for all parties.

-

Privacy-Preserving Credit Evaluation: Solutions like Chainlink DECO enable users to prove their creditworthiness using off-chain data without exposing sensitive personal information, balancing privacy with trust.

-

Reduced Default Risk Through Real-Time Monitoring: On-chain risk scores analyze up-to-date transaction and repayment data, allowing lenders to quickly identify deteriorating credit conditions and adjust terms or take action as needed.

This paradigm shift is already attracting institutional interest as well as individual users seeking more equitable access to decentralized credit. Notably, ongoing innovations such as Chainlink’s DECO protocol further enhance privacy by allowing users to prove aspects of their creditworthiness without revealing sensitive information, addressing one of the main challenges inherent in open blockchain environments.

Navigating Challenges: Privacy and Identity in Decentralized Credit

The promise of under-collateralized DeFi lending does not come without hurdles. Chief among them is the pseudonymous nature of blockchain addresses, which opens the door for sybil attacks, where individuals create multiple identities to manipulate scoring systems. To counteract this threat, leading platforms are integrating decentralized identity (DID) frameworks alongside robust anti-fraud algorithms that detect suspicious patterns across wallet clusters.

An additional challenge is balancing transparency with privacy. While immutable ledgers provide unparalleled auditability, they also raise concerns about exposing user activity histories. Innovations like zero-knowledge proofs (ZKPs) are gaining traction here; they allow borrowers to demonstrate positive repayment records or asset holdings without disclosing full details publicly, a critical development for fostering trust while preserving confidentiality.

If you’re curious about how these mechanisms work together or want practical guidance for integrating them into your own workflows as a lender or developer, explore our detailed guides at /how-onchain-risk-scores-enable-under-collateralized-lending-in-defi.

Adoption of on-chain risk scores is accelerating as DeFi protocols recognize the dual need for capital efficiency and robust risk management. The evolution of these systems is not just technical but also cultural, as communities and DAOs (Decentralized Autonomous Organizations) increasingly participate in protocol governance, shaping lending standards and dispute resolution processes. This collective oversight introduces a layer of social trust that complements algorithmic scoring, further reducing default risks in under-collateralized lending environments.

Institutional Impact and Real-World Integration

The implications for institutional players are profound. By linking on-chain risk scores to off-chain legal agreements, lenders can gain real-world recourse in the event of defaults, bridging the gap between decentralized protocols and traditional finance. Projects like Credora and zkCredit are at the forefront, leveraging zero-knowledge proofs to provide underwriters with actionable insights into borrower balances and behaviors, without compromising privacy. These advances pave the way for trillions of dollars in capital to flow into DeFi markets as risk assessment becomes more reliable and transparent.

The integration of decentralized identity (DID) solutions also opens new doors for cross-platform credit portability. Borrowers can build reputational capital across multiple protocols, creating a virtuous cycle where responsible behavior is rewarded with better loan terms throughout the ecosystem. This portability makes DeFi credit scoring far more dynamic than its traditional counterparts.

[list: Examples of DeFi platforms using on-chain risk scores for under-collateralized loans]

Yet, as adoption grows, so does the need for continuous improvement in anti-fraud techniques and data privacy safeguards. Ongoing research focuses on refining sybil resistance mechanisms and expanding the predictive power of risk models by incorporating both on-chain behavior and selective off-chain signals, always with user consent at the core.

Maximizing Opportunity While Minimizing Risk

For users eager to access under-collateralized credit or lenders seeking higher yields with managed exposure, understanding how on-chain risk scores are transforming under-collateralized crypto lending is essential. The best strategies combine rigorous due diligence with adaptive protocol selection, favoring platforms that demonstrate transparent scoring methodologies, robust DID integration, and proven track records of managing liquidations effectively.

Lenders should regularly review borrower score distributions and diversification metrics within their portfolios. Borrowers, meanwhile, can proactively improve their scores by maintaining healthy onchain repayment history, engaging with reputable projects, and diversifying asset holdings, all actions that directly impact access to lower-collateral loans.

The future is bright for decentralized credit markets that prioritize both opportunity and security. As technical standards mature, and as regulators begin to recognize the transparency benefits inherent in blockchain-based scoring, the path toward mainstream adoption becomes clearer each day.

If you’re ready to dive deeper or want practical steps for leveraging these innovations in your own DeFi journey, explore our step-by-step guides or join community discussions at /how-onchain-risk-scores-enable-under-collateralized-lending-in-defi.