Decentralized finance (DeFi) has made enormous strides in recent years, but one persistent limitation has been the requirement for borrowers to overcollateralize loans. This practice, while effective at protecting lenders, is capital-inefficient and excludes many institutional participants who cannot or will not lock up large amounts of crypto. The emergence of the onchain credit score is transforming this paradigm, paving the way for undercollateralized DeFi lending and unlocking new opportunities for institutional crypto borrowing.

Why Onchain Credit Scores Matter for Institutional Borrowers

In traditional finance, creditworthiness is assessed through a patchwork of private data, opaque scoring models, and legacy intermediaries. DeFi disrupts this by using transparent blockchain data to build real-time credit profiles. An onchain credit score synthesizes a borrower’s transaction history, protocol interactions, asset holdings, and repayment records into a dynamic risk metric. This approach offers several advantages over both legacy and early DeFi lending models:

- Transparency: All stakeholders can independently verify the data underlying each score.

- Dynamism: Scores update in real time as borrowers interact with protocols.

- No reliance on third-party bureaus: Identity and reputation are established directly on-chain.

This new infrastructure enables undercollateralized lending models that better fit the needs of institutions seeking efficient capital deployment in crypto markets. For deeper insights into how these systems work in practice, see this detailed explainer.

The Mechanics of Undercollateralized DeFi Lending

The foundation of undercollateralized lending in DeFi rests on three pillars: decentralized identity (DID), smart contract-based risk assessment protocols, and real-world asset tokenization. Each plays a critical role in making institutional crypto borrowing both feasible and scalable.

Key Components Powering Undercollateralized DeFi Lending

-

On-Chain Credit Scoring Protocols: Platforms like Cred Protocol, Credora, and Spectral Finance analyze blockchain transaction histories and behaviors to generate transparent, immutable credit scores for institutional borrowers.

-

Decentralized Identity (DID) Frameworks: Solutions such as SpruceID and Lens Protocol enable verifiable digital identities on-chain, supporting reputation-based lending and reducing reliance on traditional intermediaries.

-

Tokenization of Real-World Assets (RWAs): Platforms such as Centrifuge and Goldfinch allow borrowers to tokenize assets like invoices or real estate, using them as collateral to secure undercollateralized loans.

-

Privacy-Preserving Data Solutions: Technologies like Chainlink DECO enable the verification of sensitive off-chain data (such as income or bank balances) without exposing private information, supporting secure and compliant credit assessments.

DID frameworks, such as those built atop Ethereum or Polygon, allow institutions to create verifiable digital identities anchored by their historical on-chain activity. These identities are portable across protocols and can be enhanced with attestations from trusted counterparties or even off-chain financial records when privacy-preserving mechanisms are used.

Smart contracts, meanwhile, automate underwriting by ingesting onchain credit scores to set loan terms dynamically, without manual intervention or centralized approval processes. Leading protocols like Credora and Spectra are pioneering approaches that blend payment history analytics with liquidation event tracking to quantify borrower risk more precisely than ever before.

The Bridge Between TradFi and DeFi: Tokenizing Real-World Credit Data

A transformative trend is the tokenization of real-world assets (RWAs) for use as collateral or proof of solvency within DeFi ecosystems. By representing invoices, receivables, or even U. S. Treasuries as blockchain tokens, institutional borrowers can unlock liquidity without relying solely on volatile crypto collateral. This bridge between traditional finance (TradFi) and decentralized markets not only enhances stability but also brings new classes of borrowers into the fold, potentially adding trillions in addressable market value to DeFi platforms (see more here).

The integration of real-world credit data with blockchain-native risk assessment is rapidly evolving. As these systems mature, expect to see further convergence between stablecoin lending protocols, advanced DID solutions, and sophisticated crypto risk assessment engines, all designed with institutional needs at their core.

However, for undercollateralized DeFi lending to reach its full institutional potential, it is essential to address several operational and regulatory complexities. The infrastructure that supports decentralized identity (DID) and real-world credit data must not only be robust, but also interoperable across multiple protocols and jurisdictions. Institutions are demanding more than just transparency, they require predictable risk frameworks, privacy-preserving compliance tools, and seamless integration with their existing treasury management systems.

Scaling Institutional Access: What Comes Next?

As adoption accelerates, several trends are shaping the next phase of institutional crypto borrowing:

Top Institutional Undercollateralized DeFi Lending Trends for 2025

-

Adoption of On-Chain Credit Scoring Protocols: Leading platforms such as Cred Protocol, Credora, and Spectra are leveraging blockchain data to build decentralized credit scores, enabling more accurate risk assessments and supporting undercollateralized lending for institutions.

-

Integration of Decentralized Identity (DID) Solutions: Frameworks like Ethereum Attestation Service and Polygon ID are empowering institutional borrowers to establish verifiable digital identities, enhancing trust and reputation management in DeFi lending.

-

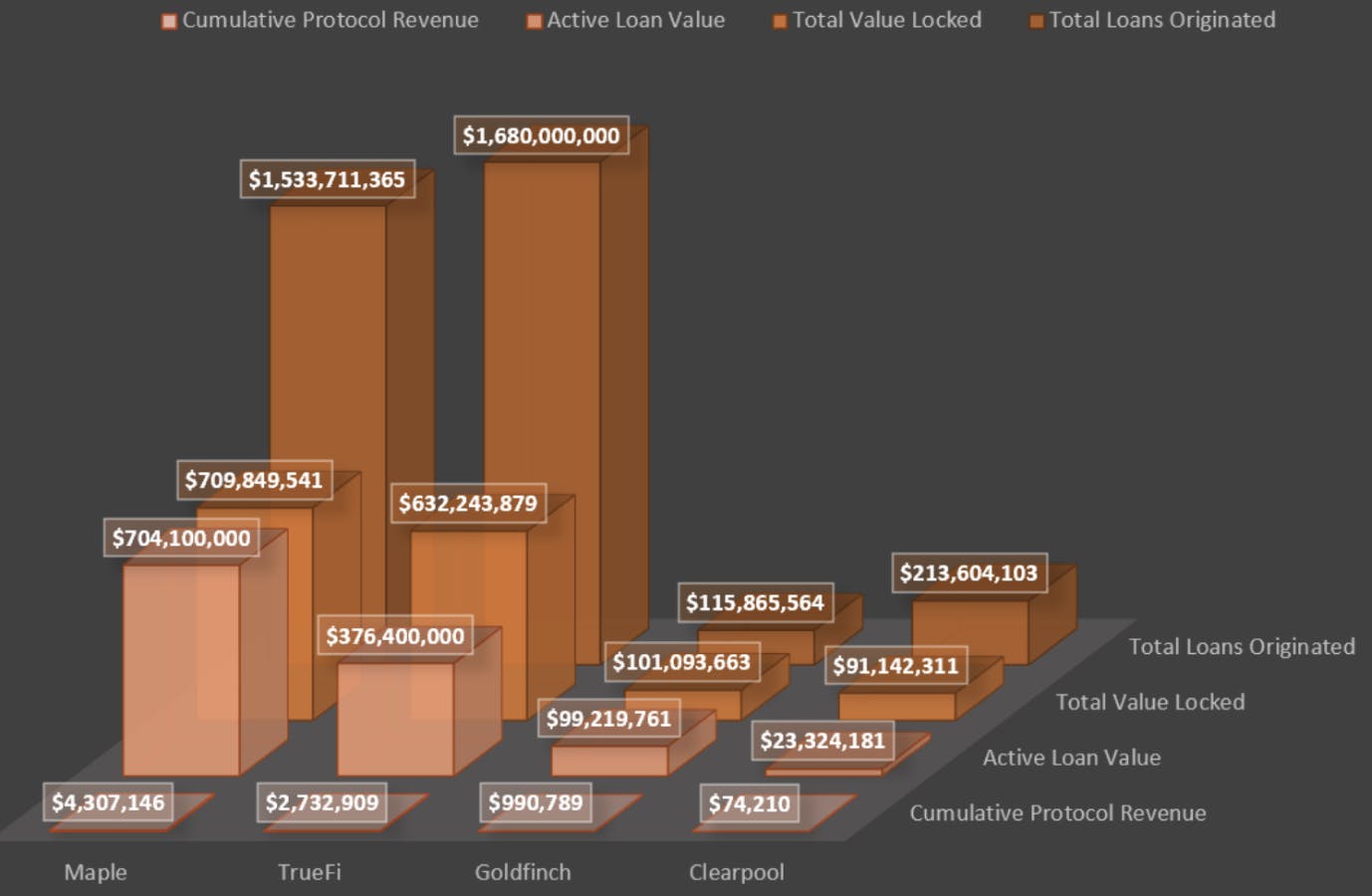

Tokenization of Real-World Assets (RWAs): Platforms such as Centrifuge and Maple Finance are facilitating the use of tokenized invoices, real estate, and bonds as collateral, bridging traditional finance and DeFi for institutional undercollateralized loans.

-

Growth of Institutional-Focused DeFi Lending Pools: Protocols like Maple Finance and Goldfinch are offering dedicated lending pools for institutions, providing access to undercollateralized loans with enhanced risk management and due diligence.

-

Advancements in Privacy-Preserving Credit Assessment: Projects such as Chainlink DECO and Zero-Knowledge Proof (ZKP) solutions are enabling privacy-preserving verification of borrower data, balancing transparency with confidentiality for institutional participants.

- Cross-chain risk scoring: Platforms are beginning to aggregate credit data from multiple blockchains, creating more holistic borrower profiles.

- Private attestation networks: New privacy layers allow off-chain financial data to be verified on-chain without exposing sensitive details, crucial for regulated entities.

- Automated default mitigation: Smart contracts can now trigger dynamic collateral calls or insurance mechanisms in response to deteriorating risk signals.

The interplay between these innovations is unlocking new forms of DeFi underwriting infrastructure, allowing lenders to tailor loan terms based on granular, real-time analytics rather than broad risk buckets. This is particularly valuable for stablecoin lending protocols seeking to balance yield generation with capital preservation in volatile markets.

Risk Management and Regulatory Outlook

The challenge for both borrowers and lenders is navigating the evolving regulatory landscape while maintaining the composability that makes DeFi attractive. Jurisdictions worldwide are scrutinizing undercollateralized lending models, especially as they begin to intersect with tokenized securities or regulated stablecoins. Forward-thinking protocols are embedding compliance checks directly into smart contracts, enabling features like whitelisted counterparties or automated KYC triggers, without sacrificing decentralization. For a deeper dive into how risk scores mitigate liquidation events in these environments, see this analysis.

The bottom line: Onchain credit scores have evolved from a niche experiment into a cornerstone of institutional DeFi infrastructure. By combining transparent blockchain analytics with privacy-preserving identity solutions and tokenized real-world assets, these systems make it possible for institutions to access capital efficiently, without the burden of excessive collateralization. As trust in onchain scoring deepens and regulatory clarity improves, expect trillions in new liquidity to migrate from traditional finance into decentralized markets.