Decentralized finance (DeFi) is undergoing a paradigm shift as onchain risk scores unlock the potential for under-collateralized crypto lending. Historically, DeFi protocols required users to post collateral far exceeding their loan value, often with loan-to-value (LTV) ratios capped at 66% or less. This capital inefficiency limited access and stifled innovation. Today, onchain credit scoring is poised to bring trillions of dollars into DeFi by making lending more inclusive, capital-efficient, and transparent.

What Are Onchain Risk Scores?

Onchain risk scores are algorithmic assessments of a borrower’s creditworthiness derived from their blockchain activity. Unlike traditional credit checks that rely on opaque institutional data and centralized authorities, these scores analyze public transaction histories, asset holdings, repayment records, and smart contract interactions directly on the blockchain. The result is a real-time, transparent metric that profiles risk at the wallet level while preserving user privacy.

This evolution in decentralized credit scoring means that anyone with a blockchain address can build a reputation based on their financial behavior rather than off-chain identity documents or legacy credit bureaus. Importantly, these scores are tied to wallet addresses – not personal identities – ensuring privacy by design.

The Mechanics Behind Under-Collateralized Crypto Lending

With robust onchain risk assessment, DeFi platforms can safely extend loans with reduced or even zero collateral requirements. This mirrors traditional finance’s unsecured lending models but leverages blockchain’s transparency and automation for greater trust and efficiency.

Several leading protocols are already integrating these innovations:

Leading DeFi Platforms Using Onchain Risk Scores

-

Cred Protocol: Implements decentralized credit scoring by analyzing onchain activity, enabling under-collateralized lending and expanding access to DeFi loans for underserved users.

-

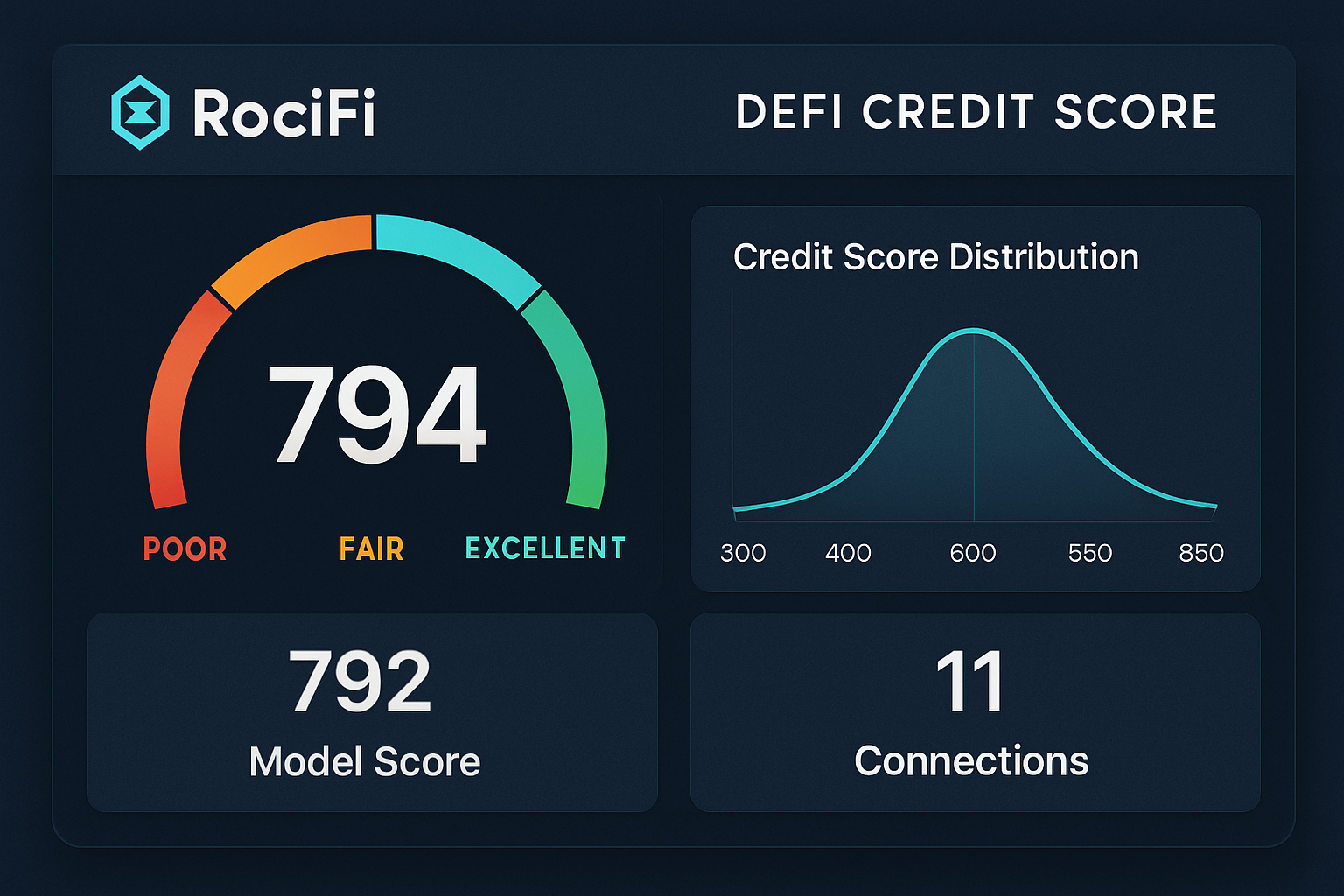

RociFi: Utilizes a multi-dimensional onchain credit scoring system that assesses fraud risk, user reputation, and creditworthiness to facilitate under-collateralized loans.

-

SoLo Protocol: Leverages both machine learning on traditional financial data and onchain analytics to create hybrid credit scores, supporting personal under-collateralized loans within the DeFi ecosystem.

-

Goldfinch: Focuses on under-collateralized lending by evaluating borrower risk through off-chain and onchain data, enabling real-world borrowers to access crypto credit.

-

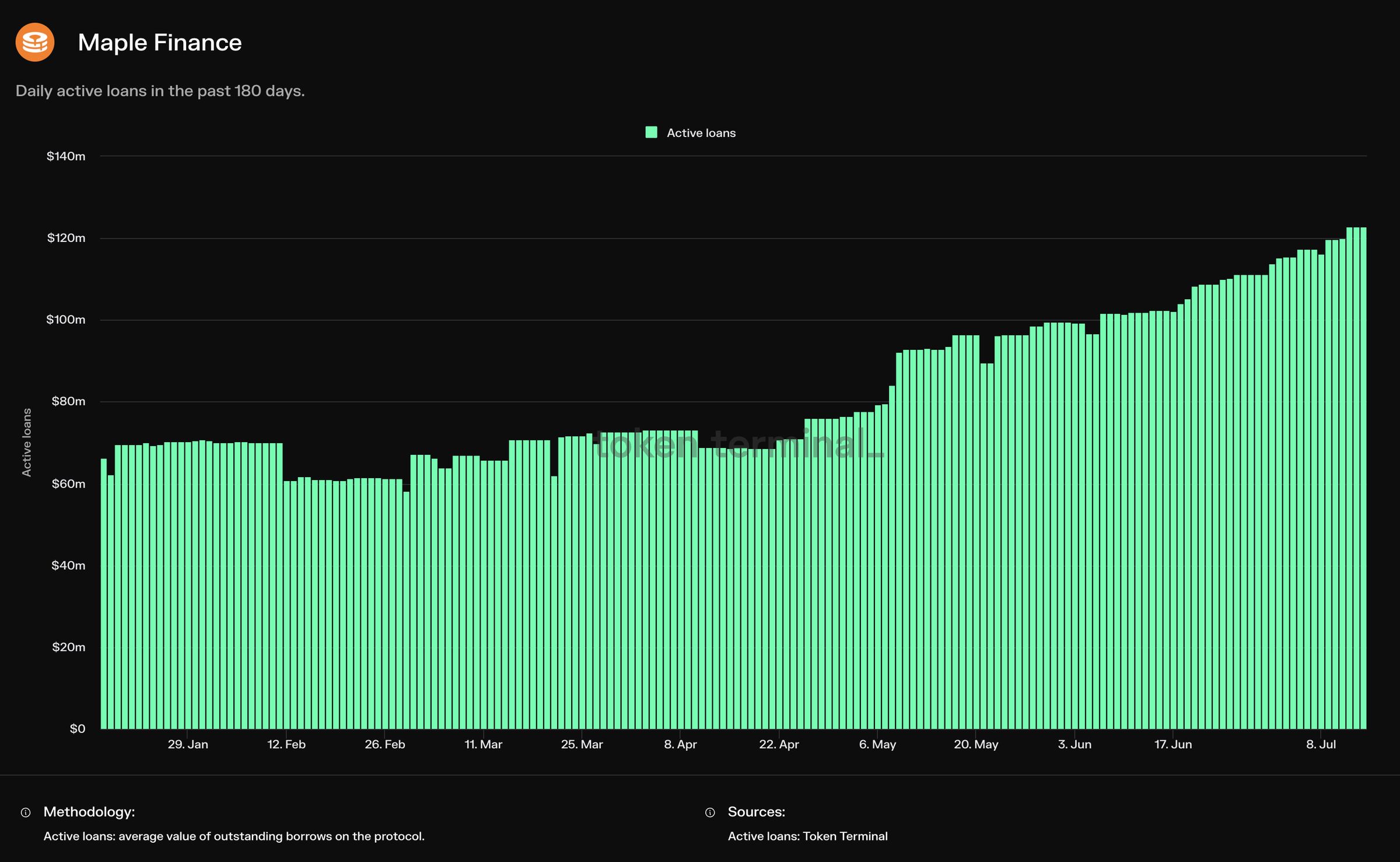

Maple Finance: Offers institutional under-collateralized lending by combining onchain credit assessment with due diligence, allowing vetted borrowers to access capital efficiently.

- RociFi: Employs multi-factor analysis including fraud detection, reputation signals, and historical repayment data to calibrate loan terms per user.

- SoLo Protocol: Combines machine learning models trained on both traditional financial data and onchain analytics to generate hybrid credit scores for personal loans.

- Credora: Utilizes zero-knowledge proofs to provide privacy-preserving yet verifiable borrower insights for underwriters.

This new breed of platforms enables borrowers without substantial crypto holdings to access much-needed liquidity while allowing lenders to price risk more dynamically rather than relying solely on over-collateralization as a blunt instrument.

The Benefits: Capital Efficiency and Financial Inclusion

The adoption of crypto credit scores brings notable advantages:

- Increased Accessibility: Users previously excluded from DeFi due to lack of collateral can now participate in borrowing markets.

- Capital Efficiency: Funds locked in excessive collateral are freed up for productive use elsewhere in the ecosystem.

- User Privacy: Since scores are linked to wallet activity rather than real-world identities, sensitive personal information remains protected.

- Dynamism: Risk models update in real time as new transaction data appears on chain, making them adaptive to changing borrower behavior.

This shift is not theoretical; it is already gaining traction as under-collateralized lending becomes one of the fastest-growing segments in digital asset finance. According to recent research from Reflexivity Research and Mitosis University, this market has achieved credible product-market fit and is compounding rapidly as protocols refine their scoring algorithms and expand their user bases.

Despite these advances, several challenges must be addressed for onchain risk scores to reach their full potential. Chief among them is the delicate balance between transparency and privacy. While blockchain’s public ledger enables open verification of credit behaviors, it also raises concerns about revealing sensitive financial patterns. Solutions such as zero-knowledge proofs, as implemented by Credora and others, are emerging to allow protocols to verify borrower reliability without exposing private details.

Another key hurdle is the accuracy and robustness of DeFi risk assessment models. Unlike traditional finance, where decades of credit data inform lending decisions, DeFi must rely on shorter and more volatile histories. Protocols are increasingly leveraging machine learning and advanced analytics to parse onchain activity, but outlier events or coordinated attacks can still challenge model integrity. Ongoing research and cross-protocol collaboration are essential to further refine these decentralized credit scoring systems.

Emerging Use Cases and Future Outlook

The integration of stablecoins with under-collateralized lending protocols is accelerating adoption. Stablecoins offer price stability amid crypto volatility, making them an ideal medium for both borrowers and lenders seeking predictable outcomes. Automated execution via smart contracts ensures near-instant settlement and eliminates manual intervention, streamlining the entire lending process.

This convergence is already producing new financial primitives: from revolving lines of credit for DAOs to microloans for unbanked populations in emerging markets. As more DeFi platforms adopt transparent risk metrics, we can expect a proliferation of innovative products that address real-world needs while preserving the core values of decentralization.

Key Takeaways for Lenders, Borrowers, and Developers

Key Takeaways: Onchain Risk Scores in Under-Collateralized Lending

-

Onchain risk scores enable credit-based lending in DeFi by assessing borrower reliability through blockchain data, reducing or eliminating collateral requirements.

-

Protocols like RociFi and Cred Protocol integrate onchain risk assessments to facilitate under-collateralized loans, expanding access to users with limited crypto holdings.

-

Hybrid approaches, such as SoLo Protocol, combine onchain analytics with traditional financial data to generate comprehensive credit scores for DeFi borrowers.

-

Onchain risk scores enhance capital efficiency by allowing lenders to allocate funds based on real-time, transparent risk profiles rather than rigid collateral ratios.

-

Data privacy and robust risk modeling remain critical challenges, requiring solutions like zero-knowledge proofs to balance transparency with borrower confidentiality.

- Lenders: Gain better tools to assess borrower reliability in real time, enabling dynamic interest rates based on actual wallet behavior.

- Borrowers: Build a portable reputation across DeFi platforms by maintaining strong repayment histories on chain.

- Developers: Leverage composable scoring modules to create new lending products or integrate with existing protocols for enhanced risk management.

The next wave of decentralized finance will be shaped by how effectively the ecosystem can harness transparent, privacy-preserving crypto credit scores. By moving beyond rigid collateral requirements toward nuanced risk-based models, DeFi is poised to unlock unprecedented capital efficiency and financial inclusion, building a more resilient and equitable digital economy in the process.