Decentralized finance is at a pivotal juncture. While DeFi lending protocols initially relied on over-collateralization to protect lenders from default, this approach has left vast swathes of potential borrowers underserved. The rise of on-chain risk scores marks a turning point, enabling under-collateralized lending that can unlock new levels of capital efficiency and inclusion across crypto markets.

The Shift from Over-Collateralization to Data-Driven Lending

Historically, DeFi platforms like Aave and Compound required borrowers to lock up assets worth more than the loan amount. This system, while secure for lenders, restricts access for users without significant crypto holdings and stifles the full potential of decentralized credit. The result? Billions in untapped liquidity and missed financial opportunities.

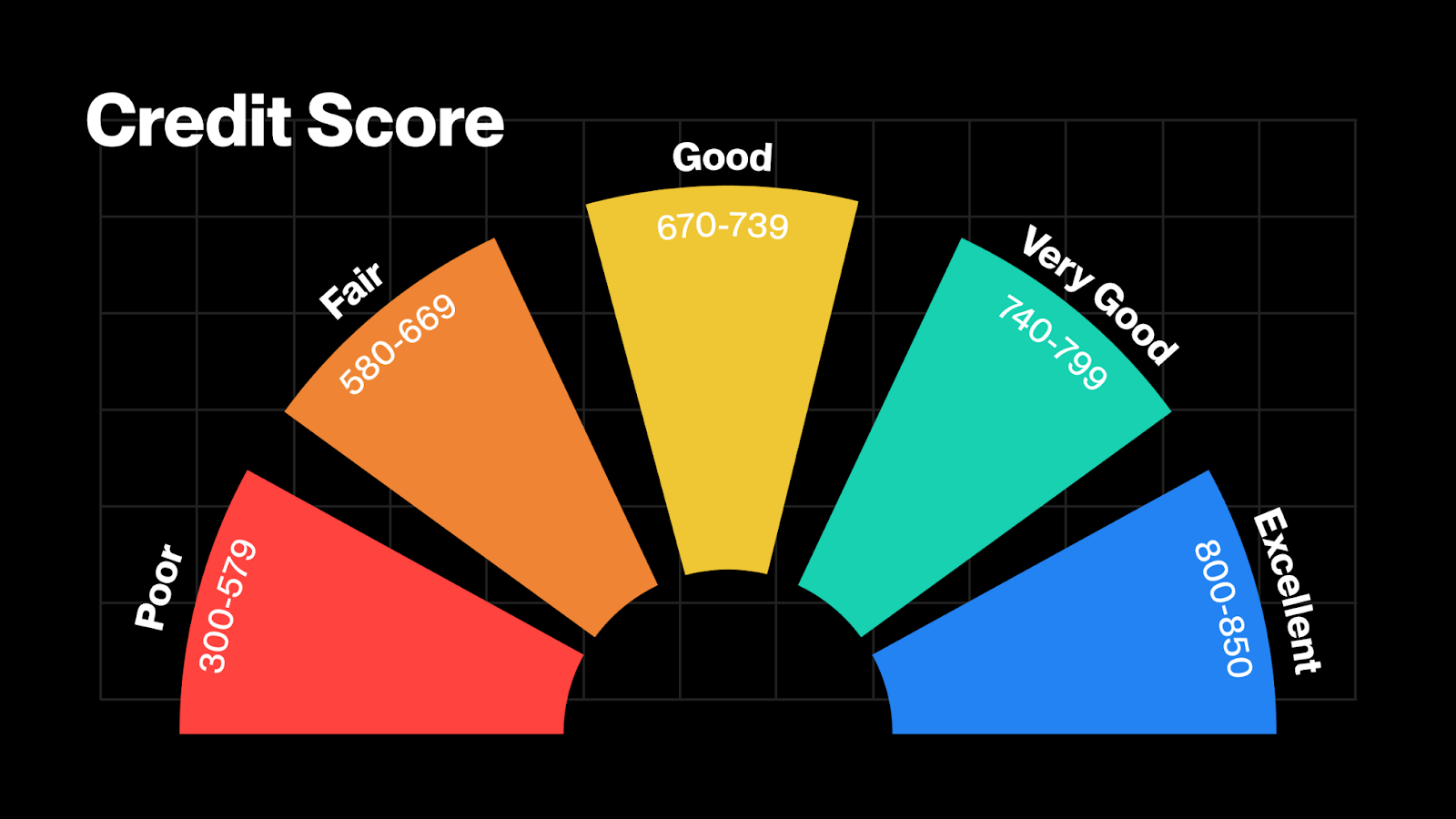

On-chain risk scores are changing this dynamic by providing a transparent, algorithmic assessment of creditworthiness based on blockchain activity. Unlike traditional credit checks that rely on opaque off-chain data, these scores analyze wallet history, transaction patterns, protocol interactions, asset diversity, and repayment records, to generate a nuanced risk profile. This empowers protocols to offer higher loan-to-value (LTV) ratios or lower interest rates for responsible borrowers while still managing default risk.

How On-Chain Risk Scores Work: The Core Mechanics

The architecture behind onchain credit score DeFi systems leverages the unique properties of blockchain: transparency, immutability, and programmability. Leading projects such as Cred Protocol, Spectral’s MACRO score, and ARCx have pioneered methodologies that:

- Aggregate wallet-level data: Including borrowing history, liquidation events, asset balances, governance participation, and collateral usage.

- Apply machine learning models: To identify patterns correlated with repayment reliability or default risk.

- Dynamically adjust loan terms: Protocols can tailor LTV ratios or interest rates in real time based on a user’s evolving on-chain reputation.

This data-driven approach not only increases capital efficiency but also incentivizes positive borrower behavior, users with strong histories are rewarded with better terms. For an in-depth look at how these mechanisms are transforming lending dynamics in practice, see this detailed guide.

The Benefits: Efficiency Meets Inclusion

The integration of decentralized credit risk tools delivers several compelling advantages for both lenders and borrowers:

- Enhanced Capital Efficiency: By matching collateral requirements to individual borrower profiles rather than imposing blanket policies across all users.

- Broader Access: Users with limited upfront capital but strong on-chain reputations can now participate fully in DeFi lending markets.

- Better Risk Management: Lenders gain granular insight into borrower reliability via transparent scoring metrics, mitigating default risks without relying solely on over-collateralization.

This shift is already attracting institutional attention. As noted by industry analysts and research from arXiv’s OCCR Score framework, the move toward robust DeFi credit scoring could bring trillions of dollars in new liquidity into decentralized finance ecosystems. For more technical details about these innovations and their implications for platform design, visit this resource.

Despite these advances, the path to widespread adoption of under-collateralized lending in DeFi is not without hurdles. The open, permissionless nature of blockchain presents unique challenges for credit risk assessment that traditional finance does not face.

Key Challenges: Navigating Privacy, Identity, and Standardization

Data privacy stands out as a central concern. While on-chain transparency is essential for verifiable scoring, it also means sensitive financial behaviors are visible to anyone. Protocols must strike a careful balance between transparency and user confidentiality. Emerging solutions such as zero-knowledge proofs are being explored to enable privacy-preserving credit scores without compromising the integrity of risk models.

Sybil attacks – where an individual creates multiple wallet addresses to game reputation systems – threaten the reliability of on-chain credit scores. Integrating decentralized identity (DID) frameworks and social graph analytics can help mitigate this risk by linking behavior across wallets or associating reputations with persistent digital identities.

Another critical challenge is standardization. With each protocol developing its own methodology for calculating risk, interoperability remains limited. Industry-wide standards for on-chain risk score calculation would foster greater trust among lenders and allow borrowers to port their reputations between platforms, unlocking even more liquidity.

Opportunities Ahead: Building a New Financial Reputation Layer

The real promise of DeFi credit scoring lies in its ability to establish a global, portable reputation layer for users, one that is not tied to geography or centralized authorities but instead anchored in transparent blockchain activity. This shift could democratize access to credit at an unprecedented scale, particularly in regions underserved by legacy banking infrastructure.

Lenders benefit from richer data sets and dynamic risk management tools, while borrowers gain agency over their financial identities and access to capital without burdensome collateral requirements. As protocols integrate ESG factors into their models, there is also potential for more sustainable lending practices that reward positive social and environmental behavior on-chain.

The next wave of innovation will likely involve deeper integrations with real-world assets (RWAs), off-chain data feeds, and advanced cryptographic techniques. As these elements coalesce, expect under-collateralized DeFi lending markets to become both safer and more inclusive, potentially rivaling traditional finance in scale and sophistication within the next decade.

The transformation underway is profound: by leveraging decentralized identity frameworks and transparent repayment histories, onchain credit score DeFi systems are not just optimizing capital efficiency, they are redefining what it means to build trust in a digital economy. For those eager to participate or innovate in this space, now is the time to engage with the emerging standards shaping the future of decentralized lending.