In 2025, the landscape of crypto lending is rapidly evolving as onchain risk scores unlock new pathways for under-collateralized borrowing. Traditional decentralized finance (DeFi) protocols have long relied on over-collateralization – often demanding users lock up 150% or more of a loan’s value – to mitigate the risks posed by asset volatility and pseudonymous users. However, this conservative approach has historically limited capital efficiency and excluded many would-be borrowers from accessing credit. The emergence of robust onchain credit scoring systems is fundamentally shifting this paradigm, enabling a more nuanced and data-driven approach to risk assessment.

Onchain Identity and Credit Scoring: The Foundation for Trust

The core innovation driving under-collateralized crypto lending in 2025 is the integration of decentralized identity (DID) frameworks with transparent, real-time repayment histories. By leveraging blockchain’s inherent auditability and advanced AI-powered analytics, protocols can now assign dynamic risk scores to individual wallets based on their actual financial behavior rather than static collateral ratios alone.

For example, the zScore system has become an industry benchmark by analyzing transaction patterns, historical borrowing activity, and repayment reliability across multiple DeFi platforms. This creates a reputation layer that persists across protocols while preserving user privacy through cryptographic proofs. Early studies show a strong correlation between high zScores and lower default rates, giving lenders greater confidence to offer loans with reduced collateral requirements.

Major rating agencies are also entering the space: S and P Global Ratings now provides stablecoin risk assessments directly onchain through Chainlink oracles. These scores range from 1 to 5 and evaluate factors such as asset quality, liquidity profiles, and regulatory status – further enhancing transparency around stablecoin-backed loans. In August 2025 alone, $51.7 billion in stablecoins were borrowed across DeFi markets, contributing to a cumulative total of over $670 billion since January 2020 (source).

How Onchain Risk Scores Power Under-Collateralized Lending

The operational mechanics behind under-collateralized crypto lending hinge on continuous monitoring and updating of borrower risk profiles. Unlike traditional models that treat all users as equally risky until proven otherwise, modern DeFi protocols can dynamically adjust loan terms based on each user’s evolving score:

- Lower Collateral Requirements: Borrowers with strong repayment histories may secure loans at significantly lower collateralization ratios – sometimes as low as 110% or even less for top-tier wallets.

- Personalized Interest Rates: Lenders can price risk more precisely by offering competitive rates to high-score borrowers while charging higher premiums for those with weaker records.

- Real-Time Liquidation Thresholds: Onchain analytics enable automated adjustments to liquidation triggers based on current market conditions and borrower behavior.

This data-driven approach not only improves capital efficiency but also democratizes access to credit within the crypto ecosystem. As a result, previously underserved segments – including small traders, DAOs, and emerging-market participants – are gaining entry into global capital markets without facing prohibitive collateral barriers.

The Market Impact: Growth Metrics and Adoption Trends

The adoption curve for under-collateralized lending powered by onchain risk assessment is steepening rapidly in 2025. According to recent reports:

- $35 billion in active loans are currently managed via onchain lending protocols (details here), underscoring both institutional interest and user demand.

- The open borrow market has rebounded sharply since the last bear cycle bottomed at $1.8 billion in Q4 of the previous year.

- Lending volumes continue to accelerate as more platforms integrate advanced credit scoring tools like zScore and OCCR Score (On-Chain Credit Risk Score).

This momentum signals growing trust in decentralized credit infrastructure – especially as transparency around borrower behavior reduces information asymmetry between lenders and borrowers. For developers building new DeFi applications or institutions seeking efficient liquidity allocation models, integrating these advanced risk metrics is fast becoming standard practice rather than an experimental add-on.

As protocols refine their risk models, the competitive landscape is shifting. Lenders are actively seeking borrowers with verifiable onchain reputations, while borrowers are incentivized to maintain positive repayment behaviors to unlock better terms. This virtuous cycle is fueling healthy competition among platforms and driving greater innovation in credit assessment algorithms.

Top DeFi Protocols Using Onchain Risk Scores in 2025

-

zScore by zkPass: Leveraging advanced AI to analyze onchain wallet behavior, zScore provides decentralized credit scores that enable under-collateralized lending by assessing transaction history, borrowing patterns, and repayment reliability.

-

Huma Finance: This protocol employs onchain credit scoring systems to evaluate borrower risk, allowing for flexible collateral requirements and improved loan accessibility based on real-time wallet data.

-

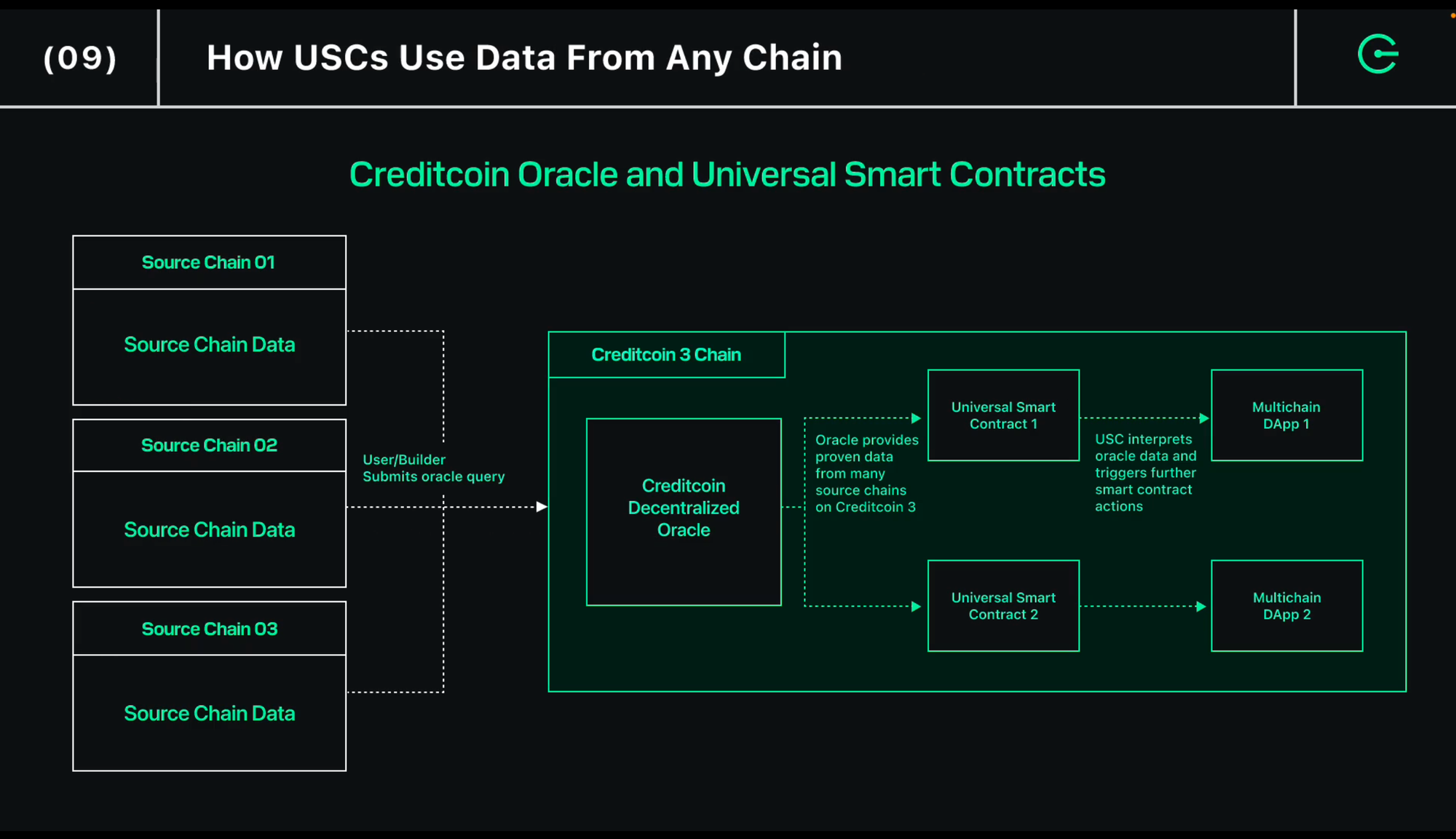

Creditcoin Network: By recording credit history and repayment data onchain, Creditcoin creates transparent borrower profiles, supporting under-collateralized lending and trustless credit markets.

-

Chainlink x S&P Global Ratings: Through its integration with S&P Global, Chainlink delivers onchain stablecoin risk scores, enhancing lender confidence and enabling more nuanced risk-based lending decisions.

-

The Lender Protocol: Utilizing onchain credit evaluations, The Lender offers under-collateralized loans by transparently assessing borrower risk and enabling dynamic loan terms.

For users, the benefits are tangible. Improved access to capital means entrepreneurs and DAOs can fund new initiatives without overextending their treasury reserves. Retail participants, often marginalized by traditional finance, now have a pathway to build credit histories that persist across DeFi ecosystems. Furthermore, as stablecoin lending volumes reach historic highs provides $51.7 billion borrowed in August 2025 alone, the importance of transparent risk metrics becomes even more pronounced in protecting both lenders and borrowers from systemic shocks.

From a technical perspective, the integration of decentralized identity (DID) and onchain analytics is enabling composable credit infrastructure. Developers can plug standardized risk scoring modules into lending protocols, insurance markets, and even decentralized exchanges. These modules draw from real-time wallet data and cross-chain activity, ushering in an era where creditworthiness is portable, privacy-preserving, and provable without centralized gatekeepers.

Key Challenges Ahead: Risk Management and Regulatory Clarity

Despite these advances, several challenges remain as the sector scales:

- Data Integrity: Protocols must guard against sybil attacks and data manipulation attempts designed to game reputation systems.

- Privacy vs. Transparency: Striking a balance between user privacy and the need for transparent risk assessment will require ongoing cryptographic innovation.

- Regulatory Uncertainty: As adoption grows, global regulators are scrutinizing DeFi’s approach to identity verification and anti-money laundering compliance, potentially impacting how onchain scores are used across jurisdictions.

Lending platforms that address these hurdles through robust governance frameworks and open-source audits will be best positioned to capture growing demand while ensuring market stability.

Looking Forward: The Future of Decentralized Credit

The rise of onchain risk scores marks a watershed moment for decentralized finance. By providing actionable insights into borrower behavior, and enabling under-collateralized lending at scale, these systems are unlocking trillions of dollars in potential liquidity for the crypto economy (more here). As adoption accelerates into 2026, expect continued convergence between traditional financial standards (like S and amp;P’s ratings) and decentralized analytics tools such as zScore or OCCR Score.

The next frontier lies in further integrating DID solutions with interoperable credit scoring modules across chains, creating a seamless user experience that combines privacy with provable trust. For lenders, developers, and end-users alike, embracing these innovations will be key to maximizing opportunity while minimizing systemic risk in an increasingly interconnected financial landscape.