Undercollateralized DeFi loans promise to unlock trillions in lending potential by ditching the excessive collateral demands of traditional protocols like Aave and Compound, which captured 89% of onchain lending volume in August 2025. Instead, platforms leverage on-chain repayment history to gauge borrower reliability, enabling crypto lending without collateral overkill. Goldfinch alone has deployed over $100 million across 18 countries, funding real-world ventures from Kenyan motorcycle taxis to Indian cookstoves. This shift hinges on transparent blockchain data, turning past repayments into predictive power for undercollateralized DeFi loans.

Shifting Tides: From Collateral-Heavy to History-Driven Lending

Overcollateralized models dominate DeFi, but they stifle accessibility; borrowers must lock up 150-200% of loan value, pricing out many. Enter onchain risk scores, which analyze wallet activity, repayment patterns, and interaction histories. Protocols like Goldfinch, Credix, and TrueFi blend this with off-chain verification, proving viable: Goldfinch’s $100 million milestone underscores demand. Sources like the Onchain Foundation project trillions flowing into DeFi via these innovations, as DeFi credit scoring replaces asset pledges with behavioral data.

Visa notes Aave and Compound’s lingering lead, yet undercollateralized lending tokenized over $30 billion onchain per Qiro Finance. This evolution addresses a core flaw: collateral ties capital inefficiently, yielding suboptimal rates. On-chain data offers a permissionless alternative, scoring users on actual performance.

Risks Exposed: Lessons from DeFi’s Collateral Crises

Undercollateralized lending amplifies default exposure; without full backing, lenders bet on repayment fidelity. The Venus Protocol hack in May 2021 exemplifies perils: inflated XVS collateral borrowed massive BTC and ETH, but a price plunge triggered $200 million in liquidations and over $100 million bad debt. Such events reveal smart contract vulnerabilities and oracle manipulations undermining even collateralized systems.

Chainlink’s DECO highlights inherent lender risks in partial collateral setups. Yet, arXiv’s On-Chain Credit Risk Score (OCCR) counters this probabilistically, quantifying risks via historical patterns. Without robust on-chain repayment history, protocols falter; with it, they simulate traditional credit bureaus on blockchain.

Top Undercollateralized DeFi Protocols

-

Goldfinch: Over $100M in loans across 18+ countries, e.g., Kenya microloans.

-

Credix: Off-chain ID integration for borrower verification.

-

TrueFi: Institutional-grade uncollateralized lending.

-

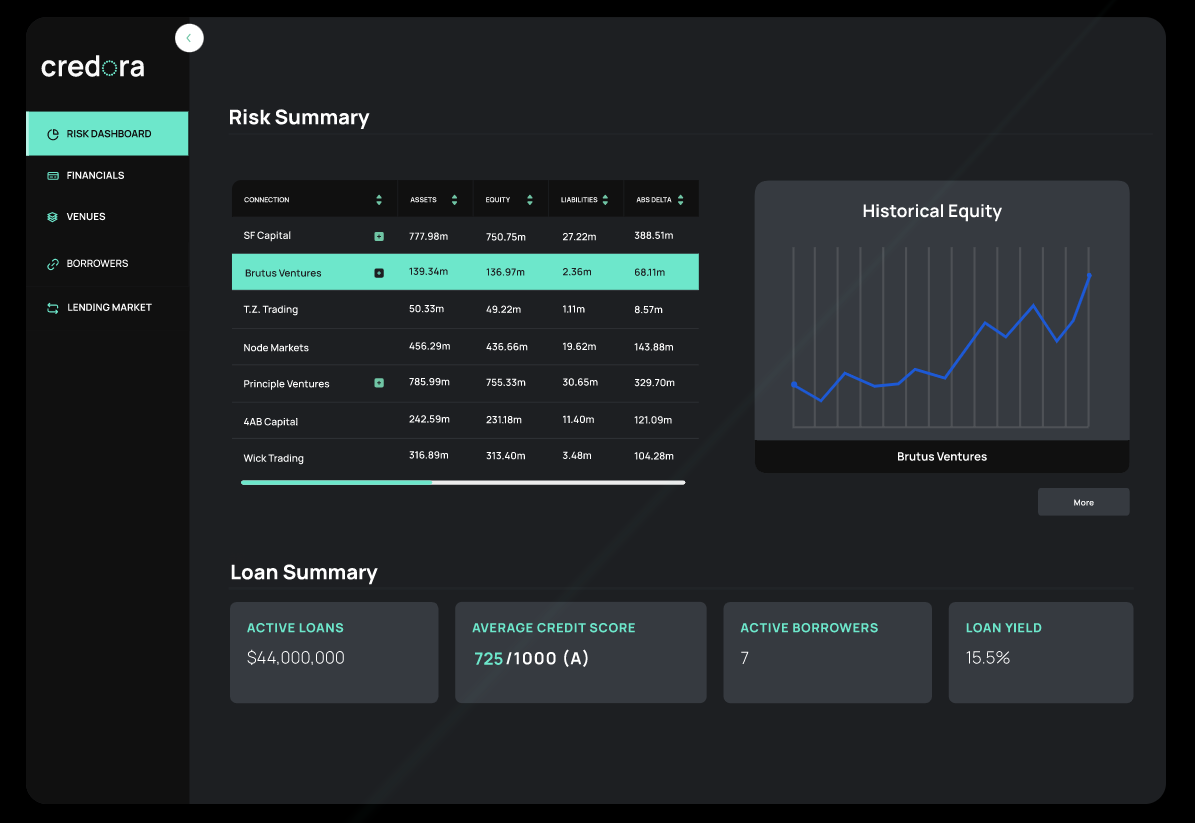

Credora: On-chain scoring via payment history.

-

Spectra: Liquidation avoidance risk metrics.

Decoding On-Chain Repayment History as a Risk Anchor

On-chain repayment history dissects borrower trajectories: timely payments, loan-to-value ratios navigated, liquidation dodges. Mitosis University details hybrid on/off-chain assessments; Binance emphasizes real-data decisions. Protocols like Cred score via payment history and liquidations, per Isaac Tham. Yeshiva University frames this as financial inclusion, bridging risk gaps with blockchain transparency.

Tim Roughgarden’s DeFi survey stresses repayment track records mirroring TradFi diligence. By indexing these metrics, onchain risk scores predict defaults better than static collateral, fostering trust. Goldfinch’s global reach validates: microloans thrive where banks won’t tread, backed by verifiable histories not asset dumps. This data layer scales lending, prioritizing performance over pledges.

Credix and TrueFi extend to institutions, tokenizing $30 billion-plus. Yet integration challenges persist; oracles must feed accurate histories without centralization. Still, the trajectory points to dominance: undercollateralized models with on-chain repayment histories yield superior efficiency, drawing capital sidelined by overcollateralization.

Quantifying these histories demands precision. Metrics like repayment velocity – the speed of principal and interest settlements – repayment ratio, or successful loans closed without liquidation, form the backbone. Add wallet age, transaction volume, and cross-protocol consistency, and you get a multidimensional onchain risk score. Credora, for instance, weights recent defaults heavily, while Spectra emphasizes liquidation avoidance, creating tailored profiles that evolve with every block.

Comparison of Leading On-Chain Credit Scoring Protocols

| Protocol | Core Focus | Key Metrics | Data Sources | Notable Impact |

|---|---|---|---|---|

| Cred | Payment History & Liquidations | Payment history, liquidations | On-chain transaction data | Assesses repayment reliability to enable undercollateralized loans |

| Spectra | Avoidance Metrics | Avoidance metrics (e.g., default avoidance) | On-chain behavioral data | Identifies low-risk borrowers through proactive risk avoidance |

| Credora | Hybrid Probabilistic Scoring | Hybrid data, probabilistic scores | On-chain + off-chain hybrid data | Delivers precise probabilistic risk models for DeFi lending decisions |

| Goldfinch | Off-Chain Verification Integration | Off-chain identity + on-chain analytics | On-chain + off-chain verification | Facilitated over $100M in loans across 18+ countries, supporting real-world initiatives |

Metrics That Matter: Building Robust Onchain Risk Scores

These scores aren’t black boxes; they’re auditable ledgers. An OCCR Score from arXiv models defaults as probabilities, factoring in-chain behaviors like flash loan interactions that signal sophistication or manipulation. Data from Qiro Finance shows protocols tokenizing $30 billion already rely on such granularity, outperforming collateral-only checks. Lenders query these via APIs, adjusting rates dynamically: low-risk borrowers snag 5-8% yields, high-risk pay 15% and, all without locking excess assets.

Opinion: Collateral feels like training wheels on a superbike – safe but sluggish. On-chain repayment history strips them off, revealing true velocity. Goldfinch’s 18-country footprint proves it; they’ve funneled $100 million to unbanked hustlers, with default rates under 5% per public audits. That’s not luck; it’s data dominance.

Overcoming Hurdles: Oracles, Privacy, and Scalability

Challenges loom large. Oracle reliability falters under manipulation, as Venus taught us with its $200 million liquidation cascade. Privacy-conscious users balk at exposing full histories; solutions like zero-knowledge proofs let protocols verify scores without revealing identities. DECO from Chainlink aims here, enabling undercollateralized setups securely. Scalability bites too – Ethereum’s congestion spikes query costs, pushing action to L2s like Base or Optimism where TrueFi thrives.

Yet momentum builds. Mitosis University’s deep dive shows hybrid models – on-chain purity plus off-chain KYC – slashing risks 30-40%. Binance guides underscore real-data decisions fueling inclusion; Yeshiva taps blockchain’s edge for underserved markets. Isaac Tham’s analysis spotlights Cred, Spectra, Credora as pioneers, blending histories with liquidation stats for yields beating Aave’s 89% volume stranglehold.

Undercollateralized protocols now integrate these natively. TrueFi courts institutions with audited histories, Credix layers real-world assets. Per Onchain Foundation, trillions await as DeFi credit scoring matures, unlocking crypto lending without collateral at scale.

Tim Roughgarden’s fundamentals survey nails it: investors dissect issuer strength via repayment records, just as TradFi does. In DeFi, this permissionless truth serum builds trust sans intermediaries. Goldfinch’s Kenyan taxis and Indian stoves hum on repayments, not riches. As oracles harden and ZK tech proliferates, expect explosion: $30 billion today scales to trillions tomorrow, collateral be damned.

Protocols embedding transparent on-chain repayment histories don’t just lend; they evolve capital markets. Lenders gain precision, borrowers access, ecosystems liquidity. Undercollateralized DeFi loans, anchored by history, redefine risk – not as enemy, but edge.